US 3D Printing Filament Market Summary

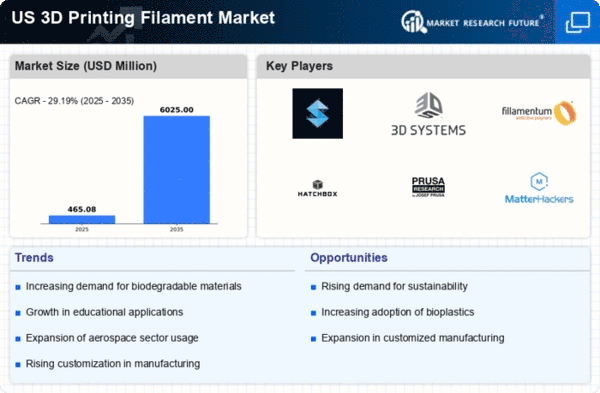

As per Market Research Future analysis, the US 3D Printing Filament Market Size was estimated at 360.0 USD Million in 2024. The US 3d printing-filament market is projected to grow from 465.08 USD Million in 2025 to 6025.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 29.1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US 3D Printing Filament Market is experiencing a transformative shift towards sustainability and innovation.

- Sustainable materials adoption is becoming increasingly prevalent, reflecting a broader environmental consciousness among consumers and manufacturers.

- Technological advancements in 3D printing are enhancing the quality and efficiency of filament production, driving market growth.

- Customization and personalization are gaining traction, particularly in the consumer goods and healthcare segments, which are among the largest in the market.

- The rise of small-scale manufacturing and increased demand for prototyping are key drivers propelling the market forward.

Market Size & Forecast

| 2024 Market Size | 360.0 (USD Million) |

| 2035 Market Size | 6025.0 (USD Million) |

| CAGR (2025 - 2035) | 29.19% |

Major Players

Stratasys (US), 3D Systems (US), Filamentum (CZ), Hatchbox (US), Prusa Research (CZ), MatterHackers (US), ColorFabb (NL), Raise3D (US), eSUN (CN)