Emergence of Smart Cities

The development of smart cities is a pivotal factor propelling the 5G Capacitor Market. As urban areas increasingly adopt smart technologies to improve infrastructure, transportation, and public services, the demand for reliable and efficient capacitors rises. Smart city initiatives often rely on 5G networks to facilitate real-time data exchange and connectivity among various devices. This trend is expected to drive the 5g capacitor market, as municipalities seek to implement advanced communication systems that require high-performance capacitors. With estimates suggesting that smart city investments could reach $1 trillion by 2030, the 5g capacitor market stands to gain significantly from this transformative urban development.

Growing Adoption of Electric Vehicles

The surge in electric vehicle (EV) adoption is influencing the 5G Capacitor Market significantly. As EV manufacturers integrate advanced communication technologies to enhance vehicle performance and connectivity, the demand for capacitors that can support these systems increases. The 5g capacitor market is expected to see a notable uptick, with projections indicating that the EV sector could account for nearly 15% of the total capacitor demand by 2027. This trend is driven by the need for efficient energy storage and management systems in EVs, which rely on high-quality capacitors to ensure optimal performance and reliability. Thus, the intersection of the automotive and telecommunications sectors presents a unique opportunity for growth in the 5g capacitor market.

Increased Investment in Infrastructure

Investment in telecommunications infrastructure is a critical driver for the 5G Capacitor Market. As the US government and private sector stakeholders allocate substantial funds towards enhancing network capabilities, the demand for high-performance capacitors rises. Recent reports indicate that the US is expected to invest approximately $100 billion in 5G infrastructure over the next few years. This investment not only supports the deployment of 5G networks but also stimulates innovation in capacitor technology, leading to the development of more efficient and compact solutions. Consequently, the 5g capacitor market is likely to benefit from this influx of capital, as manufacturers strive to meet the evolving needs of the telecommunications industry.

Rising Demand for High-Speed Connectivity

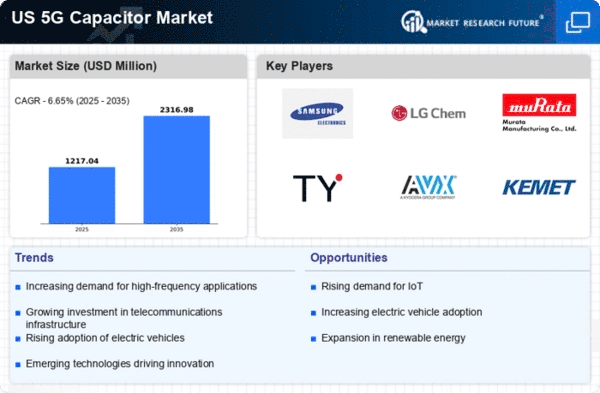

The increasing demand for high-speed connectivity in various sectors, including telecommunications, automotive, and smart cities, drives the 5G Capacitor Market. As consumers and businesses seek faster data transmission and improved network reliability, the need for advanced capacitors that can support 5G technology becomes paramount. The 5g capacitor market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 20% through 2026. This growth is fueled by the proliferation of Internet of Things (IoT) devices and the expansion of 5G networks across urban and rural areas, necessitating the development of capacitors that can handle higher frequencies and power levels.

Technological Innovations in Capacitor Design

Technological innovations in capacitor design are reshaping the landscape of the 5G Capacitor Market. Manufacturers are increasingly focusing on developing capacitors that offer enhanced performance, miniaturization, and energy efficiency. Innovations such as multilayer ceramic capacitors (MLCCs) and organic capacitors are gaining traction, as they provide superior performance characteristics suitable for 5G applications. The 5g capacitor market is likely to experience growth as these advanced designs become more prevalent, catering to the specific needs of high-frequency applications. Furthermore, ongoing research and development efforts are expected to yield new materials and manufacturing techniques, further driving the evolution of capacitor technology in the context of 5G.