Growth of E-Sports and Gaming

The US 5K Display Resolution Market is significantly influenced by the rapid growth of the e-sports and gaming sectors. As gaming enthusiasts increasingly seek immersive experiences, the demand for high-resolution displays has surged. The gaming industry in the United States is projected to reach a market value of over 200 billion USD by 2026, with a substantial portion of this growth attributed to the adoption of advanced display technologies. Gamers are now prioritizing visual quality, leading to a preference for 5K displays that offer superior graphics and detail. This trend is further supported by the development of gaming consoles and PCs capable of supporting 5K resolutions, indicating a robust future for the market as it aligns with the evolving needs of gamers.

Advancements in Display Technology

Technological advancements play a crucial role in the US 5K Display Resolution Market. Innovations in panel technology, such as OLED and Mini-LED, have significantly improved the performance and affordability of 5K displays. These advancements not only enhance color accuracy and contrast ratios but also reduce production costs, making 5K displays more accessible to a wider audience. As a result, the market is witnessing an influx of new products that cater to both professional and consumer segments. Furthermore, the integration of advanced features like HDR (High Dynamic Range) and improved refresh rates is likely to attract more users, thereby expanding the market's reach. The ongoing research and development efforts in display technology suggest a promising future for the 5K display segment.

Consumer Preference for Premium Products

The US 5K Display Resolution Market is also benefiting from a growing consumer preference for premium products. As disposable incomes rise, consumers are increasingly willing to invest in high-end technology that offers superior performance and aesthetics. This trend is particularly evident in the consumer electronics sector, where 5K displays are becoming a sought-after choice for home entertainment systems and professional setups. Market data indicates that sales of premium displays have been on the rise, with 5K models capturing a significant share of this segment. This shift in consumer behavior suggests that manufacturers may focus on developing more premium offerings, thereby enhancing the overall market landscape and driving further growth in the 5K display category.

Rising Demand for High-Resolution Displays

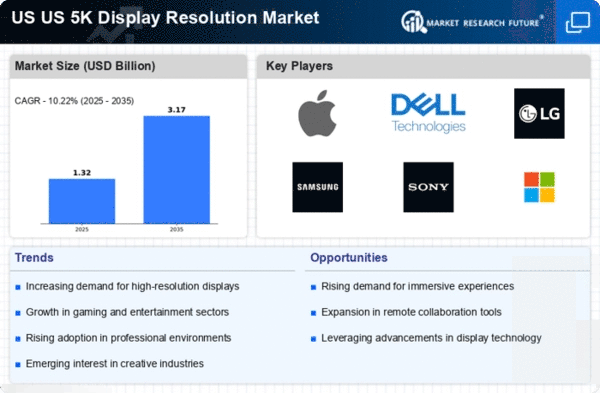

The US 5K Display Resolution Market is experiencing a notable surge in demand for high-resolution displays across various sectors. This trend is particularly evident in the creative industries, where professionals seek enhanced visual fidelity for graphic design, video editing, and photography. According to recent data, the market for high-resolution displays is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years. This growth is driven by the increasing need for precision and detail in visual content, which 5K displays can provide. As consumers become more discerning about display quality, manufacturers are responding by innovating and expanding their product lines to include 5K options, thereby solidifying the market's position in the broader display technology landscape.

Increased Focus on Remote Work and Education

The shift towards remote work and online education has had a profound impact on the US 5K Display Resolution Market. As more individuals work and learn from home, the demand for high-quality displays has escalated. Professionals and students alike are seeking displays that enhance productivity and provide a better viewing experience during video conferences and online classes. The market for monitors, including 5K displays, is expected to grow as organizations and educational institutions invest in technology to support remote operations. This trend suggests that the 5K display segment will continue to thrive as it meets the needs of a changing workforce and educational landscape, potentially leading to increased sales and market penetration.