Rising Demand for Air Travel

The aircraft fire-protection-systems market is experiencing growth due to the rising demand for air travel in the US. As more passengers opt for air travel, airlines are compelled to expand their fleets and enhance safety measures, including fire protection systems. The International Air Transport Association (IATA) forecasts that air passenger numbers will reach 4.2 billion by 2025, which necessitates the installation of advanced fire protection systems in new aircraft. This surge in demand is likely to stimulate investments in fire protection technologies, thereby propelling market growth.

Growth of the Aerospace Industry

The growth of the aerospace industry in the US is a significant driver for the aircraft fire-protection-systems market. With the expansion of both commercial and military aviation, there is an increasing need for advanced fire protection solutions. The aerospace sector is projected to grow at a CAGR of 4.5% through 2027, leading to heightened investments in safety technologies, including fire protection systems. This growth is likely to create new opportunities for manufacturers and suppliers in the market, as they seek to meet the evolving demands of the aerospace industry.

Increased Focus on Aircraft Maintenance

The aircraft fire-protection-systems market is positively impacted by an increased focus on aircraft maintenance and safety checks. Airlines are investing more in regular maintenance schedules to ensure compliance with safety regulations and to enhance operational reliability. This trend is driven by the need to prevent incidents that could lead to catastrophic failures, including in-flight fires. As a result, the demand for effective fire protection systems is likely to rise, with maintenance-related expenditures in the aviation sector expected to reach $100 billion by 2026, further bolstering the market.

Regulatory Compliance and Safety Standards

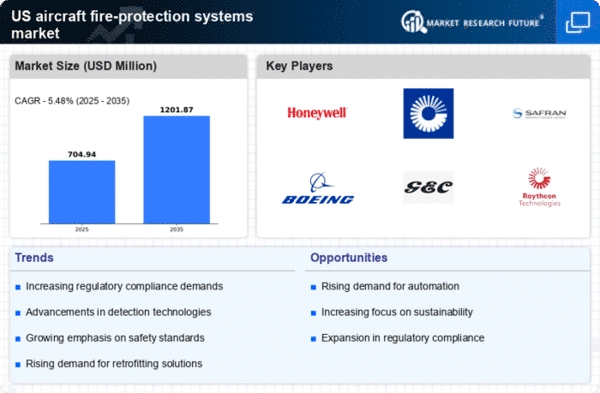

The aircraft fire-protection-systems market is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities in the US. These regulations mandate the implementation of advanced fire protection systems to ensure passenger safety and minimize risks associated with in-flight fires. The Federal Aviation Administration (FAA) and other regulatory bodies continuously update safety protocols, which drives manufacturers to innovate and enhance their fire protection technologies. As a result, the market is projected to grow at a CAGR of approximately 5.2% over the next five years, reflecting the increasing emphasis on safety and compliance in the aviation sector.

Technological Innovations in Fire Detection

Technological innovations in fire detection and suppression systems are pivotal drivers of the aircraft fire-protection-systems market. The integration of advanced sensors, artificial intelligence, and real-time monitoring systems enhances the effectiveness of fire protection measures. These innovations not only improve response times but also reduce false alarms, which is crucial for maintaining operational efficiency in aviation. As airlines and manufacturers prioritize safety, the adoption of these cutting-edge technologies is expected to increase, contributing to a projected market growth of 6% annually over the next few years.