Growing Demand for Data-Driven Insights

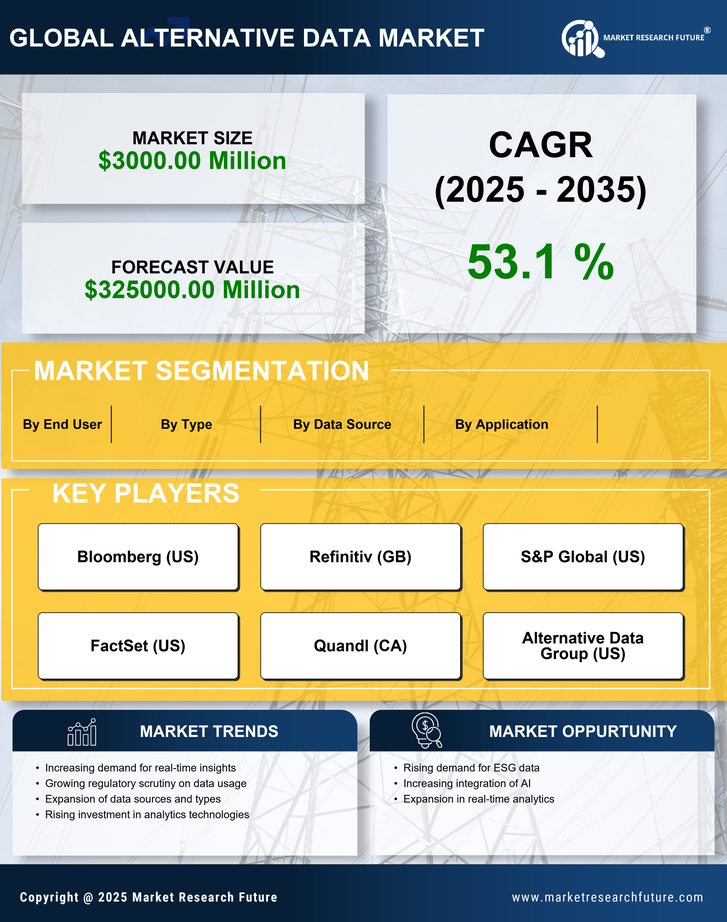

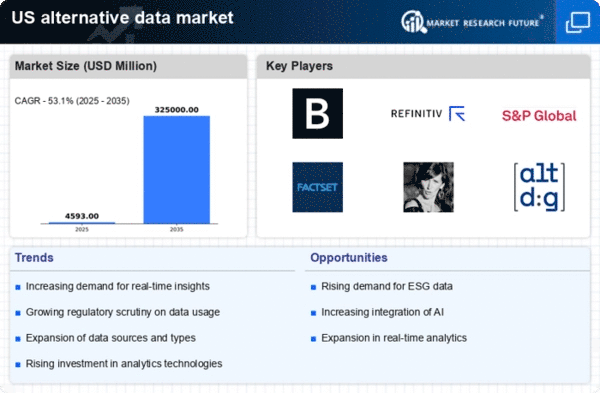

The alternative data market is experiencing a surge in demand as businesses increasingly seek data-driven insights to enhance decision-making processes. Companies are leveraging alternative data to gain competitive advantages, with the market projected to reach $10 billion by 2026. This growth is fueled by the need for real-time analytics and predictive modeling, which are essential for navigating complex market dynamics. As organizations recognize the value of alternative data in identifying trends and consumer behavior, the industry is likely to expand further. The integration of alternative data into traditional data frameworks is becoming commonplace, indicating a shift towards more comprehensive data strategies. This trend suggests that the alternative data market will continue to thrive as businesses prioritize data utilization in their operational frameworks.

Increased Investment in Fintech and Insurtech

The alternative data market is witnessing increased investment from the fintech and insurtech sectors, as these industries recognize the value of alternative data in enhancing risk assessment and underwriting processes. Financial institutions are utilizing alternative data to improve credit scoring models and identify potential fraud, leading to more informed lending decisions. The insurtech sector is similarly leveraging alternative data to refine underwriting practices and tailor insurance products to individual customer needs. This trend is indicative of a broader shift towards data-centric approaches in financial services, with the alternative data market projected to grow significantly as a result. As investment in these sectors continues to rise, the demand for alternative data solutions is expected to expand, further driving innovation and competition within the market.

Technological Advancements in Data Processing

Technological advancements are playing a pivotal role in shaping the alternative data market. Innovations in data processing technologies, such as artificial intelligence and machine learning, are enabling companies to analyze vast amounts of alternative data efficiently. These technologies facilitate the extraction of actionable insights from unstructured data sources, which is crucial for businesses aiming to stay ahead in competitive landscapes. The alternative data market is projected to grow at a CAGR of 30% through 2025, driven by these advancements. Furthermore, the rise of cloud computing has made it easier for organizations to store and process large datasets, thereby enhancing their analytical capabilities. As technology continues to evolve, the alternative data market is expected to witness increased investment and innovation, further solidifying its importance in the data ecosystem.

Regulatory Changes and Compliance Requirements

Regulatory changes are significantly impacting the alternative data market, as businesses must navigate an increasingly complex landscape of compliance requirements. The introduction of new data protection laws and regulations necessitates that companies adopt stringent measures to ensure data privacy and security. This has led to a heightened focus on ethical data sourcing and usage within the alternative data market. Organizations are investing in compliance frameworks to mitigate risks associated with data breaches and legal repercussions. As a result, the alternative data market is likely to see a shift towards more transparent and responsible data practices. This trend not only enhances consumer trust but also positions companies to leverage alternative data more effectively while adhering to regulatory standards. The evolving regulatory environment is thus a critical driver of growth and innovation in the alternative data market.

Emergence of Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are emerging as a key driver in the alternative data market, as companies seek to enhance their data offerings and analytical capabilities. By collaborating with data providers, technology firms, and Industry expert's, organizations can access a wider array of alternative data sources and improve their analytical frameworks. This trend is particularly evident in sectors such as finance, retail, and healthcare, where data-driven insights are crucial for operational success. The alternative data market is likely to benefit from these partnerships, as they foster innovation and facilitate the development of new data products and services. As companies continue to recognize the importance of collaboration in navigating the complexities of data analysis, the alternative data market is expected to see a proliferation of strategic alliances that enhance its overall growth and dynamism.