Consumer Awareness of Road Safety

Consumer awareness regarding road safety is a significant driver for the anti lock-braking-system market. As more individuals become informed about the benefits of anti lock braking systems, there is a growing preference for vehicles equipped with these safety features. Surveys indicate that approximately 60% of US consumers prioritize safety features when purchasing a vehicle, which includes anti lock braking systems. This heightened awareness is prompting manufacturers to highlight these features in their marketing strategies, thereby increasing demand. The anti lock-braking-system market is likely to expand as consumers continue to seek vehicles that offer enhanced safety and reliability.

Increasing Vehicle Safety Standards

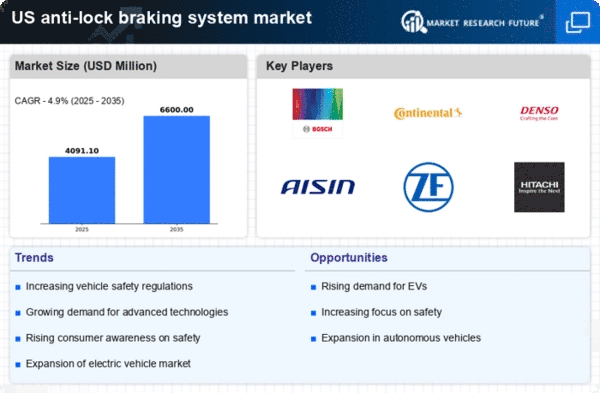

The anti lock-braking-system market is experiencing growth due to the rising emphasis on vehicle safety standards in the US. Regulatory bodies are mandating advanced safety features, including anti lock braking systems, to reduce road accidents. In 2025, it is estimated that vehicles equipped with anti lock braking systems will account for over 70% of new car sales in the US. This shift is driven by consumer demand for safer vehicles, as well as insurance incentives for cars with advanced safety features. Consequently, manufacturers are investing in the development of more efficient and reliable anti lock-braking systems to meet these standards, thereby propelling the market forward.

Rising Demand for Electric Vehicles

The anti lock-braking-system market is also influenced by the growing demand for electric vehicles (EVs) in the US. As EV sales continue to rise, manufacturers are increasingly incorporating anti lock braking systems into their designs to ensure optimal safety and performance. In 2025, it is anticipated that EVs will represent nearly 25% of total vehicle sales in the US, creating a substantial opportunity for the anti lock-braking-system market. This shift towards electrification necessitates the development of braking systems that are compatible with electric drivetrains, further driving innovation and market growth. The alignment of anti lock braking systems with EV technology is likely to enhance their adoption.

Government Incentives for Safety Features

Government incentives aimed at promoting vehicle safety are playing a crucial role in the anti lock-braking-system market. Various state and federal programs offer financial benefits for consumers purchasing vehicles equipped with advanced safety technologies, including anti lock braking systems. In 2025, it is projected that these incentives will lead to a 10% increase in the adoption of vehicles with anti lock braking systems. This trend not only encourages consumers to invest in safer vehicles but also motivates manufacturers to incorporate these systems into their designs. As a result, the anti lock-braking-system market is likely to see sustained growth driven by these government initiatives.

Technological Integration in Automotive Systems

The integration of advanced technologies in automotive systems is a key driver for the anti lock-braking-system market. Innovations such as electronic stability control and adaptive cruise control are increasingly being combined with anti lock braking systems to enhance vehicle performance and safety. In 2025, the market for these integrated systems is projected to grow by approximately 15% annually. This trend indicates a shift towards more sophisticated braking solutions that not only prevent wheel lock-up but also improve overall vehicle handling. As manufacturers continue to innovate, the anti lock-braking-system market is likely to benefit from these technological advancements, attracting both consumers and automotive companies.