Increasing Healthcare Expenditure

The rise in healthcare expenditure in the US is a significant driver for the aortic valve market. With healthcare spending projected to reach $6 trillion by 2027, there is a growing investment in advanced medical technologies, including aortic valve replacements. This increase in funding allows for the development and adoption of cutting-edge aortic valve solutions, which are essential for treating complex cardiovascular conditions. Additionally, the shift towards value-based care models encourages healthcare providers to invest in technologies that improve patient outcomes and reduce long-term costs. As hospitals and clinics allocate more resources to cardiovascular care, the aortic valve market is expected to benefit from enhanced access to innovative treatments and improved patient management strategies. This trend indicates a robust future for the aortic valve market, as financial support continues to drive advancements in treatment options.

Growing Awareness and Screening Programs

The growing awareness of cardiovascular health and the implementation of screening programs are pivotal in driving the aortic valve market. Public health initiatives aimed at educating the population about heart health have led to increased screening for valve disorders. As a result, more patients are being diagnosed with aortic valve conditions at earlier stages, which facilitates timely intervention. The American Heart Association reports that early detection can significantly improve treatment outcomes, thereby increasing the demand for aortic valve replacements. Furthermore, healthcare providers are increasingly advocating for routine cardiovascular screenings, particularly among high-risk populations. This proactive approach not only enhances patient awareness but also contributes to the overall growth of the aortic valve market, as more individuals seek treatment options for their diagnosed conditions.

Technological Innovations in Valve Design

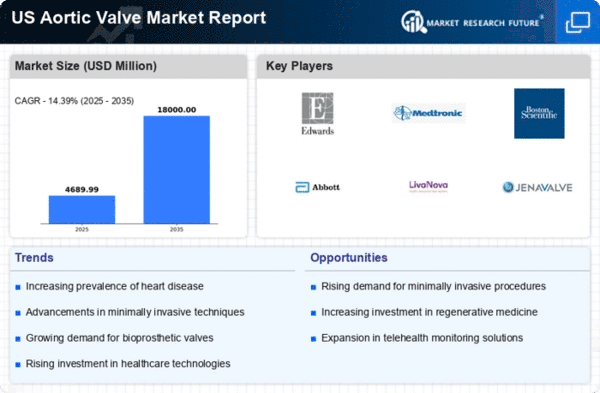

Technological advancements in valve design are transforming the aortic valve market. Innovations such as transcatheter aortic valve replacement (TAVR) and bioprosthetic valves are gaining traction due to their minimally invasive nature and improved patient outcomes. The market for TAVR is expected to reach approximately $5 billion by 2026, reflecting a compound annual growth rate (CAGR) of approximately 14.39%. These advancements not only enhance the safety and efficacy of procedures but also cater to a broader range of patients, including those deemed high-risk for traditional surgery. The integration of digital technologies, such as 3D printing and advanced imaging techniques, further supports the development of personalized valve solutions. As healthcare providers increasingly adopt these innovative technologies, the aortic valve market is likely to experience substantial growth, driven by the demand for improved surgical options and patient care.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is a crucial driver for the aortic valve market. The US Food and Drug Administration (FDA) has streamlined the approval process for new aortic valve technologies, encouraging manufacturers to bring novel solutions to market. This regulatory environment fosters innovation and competition, leading to the development of advanced aortic valve products that meet the evolving needs of patients and healthcare providers. The FDA's focus on expediting the review of breakthrough devices has resulted in a surge of new aortic valve options, enhancing treatment choices for patients. As regulatory bodies continue to support the introduction of innovative therapies, the aortic valve market is likely to expand, driven by the availability of cutting-edge solutions that improve patient outcomes and procedural efficiency.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in the US is a primary driver for the aortic valve market. As the population ages, the prevalence of conditions such as aortic stenosis and regurgitation rises, necessitating surgical interventions. According to recent data, approximately 5.5 million individuals in the US are diagnosed with heart valve disorders, with a significant portion requiring aortic valve replacement. This growing patient population is likely to propel demand for innovative aortic valve solutions, thereby expanding the market. Furthermore, the aging demographic, particularly those over 65 years, is projected to increase, further intensifying the need for effective treatment options in the aortic valve market. The healthcare system's focus on improving patient outcomes and reducing hospital readmission rates contributes to the market's growth. Advanced aortic valve technologies offer enhanced durability and performance.