Growing Demand for Sustainable Transportation

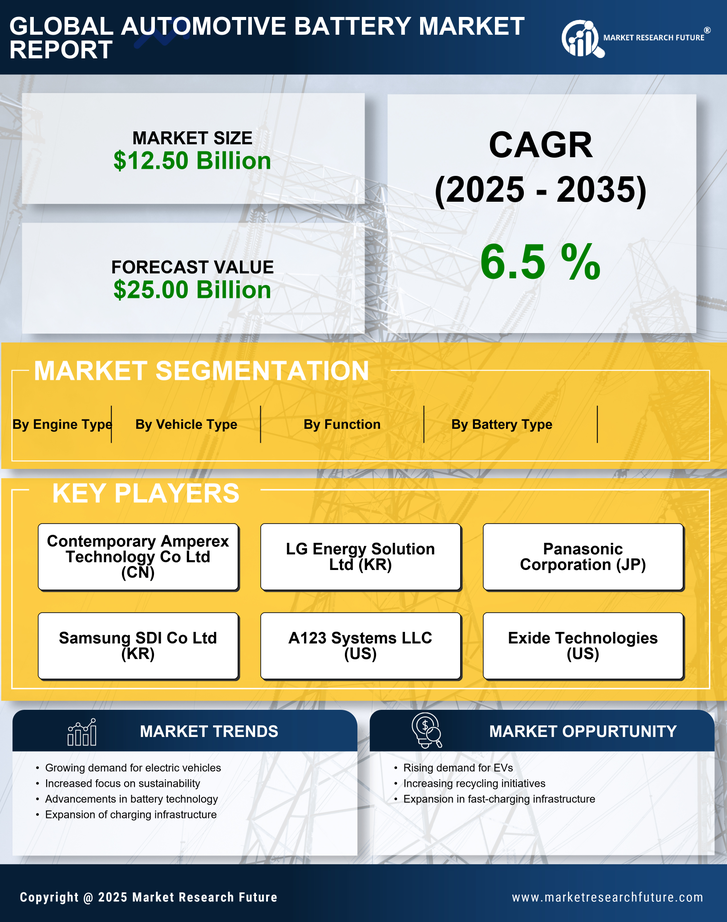

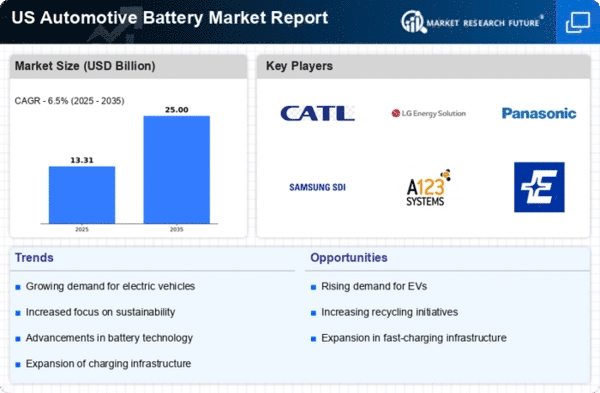

The automotive battery market is experiencing a notable surge in demand driven by the increasing consumer preference for sustainable transportation solutions. As environmental concerns gain prominence, consumers are gravitating towards electric vehicles (EVs) and hybrid models, which rely heavily on advanced battery technologies. In 2025, the market for electric vehicles in the US is projected to reach approximately $100 billion, indicating a robust growth trajectory. This shift towards greener alternatives is compelling manufacturers to innovate and enhance battery performance, thereby propelling the automotive battery market forward. Furthermore, government incentives and regulations aimed at reducing carbon emissions are likely to bolster this trend, creating a favorable environment for the automotive battery market to thrive.

Technological Innovations in Battery Chemistry

Technological advancements in battery chemistry are significantly influencing the automotive battery market. Innovations such as lithium-sulfur and solid-state batteries are emerging, offering higher energy densities and improved safety profiles compared to traditional lithium-ion batteries. These advancements could potentially enhance the range and efficiency of electric vehicles, making them more appealing to consumers. In 2025, the market for advanced battery technologies is expected to account for over 30% of the total automotive battery market, reflecting a shift towards more efficient energy storage solutions. As manufacturers invest in research and development, the automotive battery market is likely to witness a transformation that aligns with the evolving needs of the automotive industry.

Regulatory Support for Electric Vehicle Adoption

Regulatory frameworks in the US are increasingly favoring the adoption of electric vehicles, which in turn is driving growth in the automotive battery market. Federal and state governments are implementing policies that promote EV usage, including tax incentives, rebates, and stricter emissions standards. For instance, the Biden administration has set a target for 50% of all new vehicle sales to be electric by 2030. This regulatory support is expected to create a substantial demand for automotive batteries, as manufacturers will need to ramp up production to meet the anticipated increase in electric vehicle sales. Consequently, the automotive battery market is poised for significant expansion as it aligns with governmental objectives aimed at reducing greenhouse gas emissions.

Rising Investment in Renewable Energy Integration

The automotive battery market is also being influenced by the rising investment in renewable energy sources. As the US transitions towards a more sustainable energy grid, the integration of renewable energy with electric vehicle charging infrastructure is becoming increasingly important. This synergy not only enhances the appeal of electric vehicles but also necessitates the development of advanced battery systems capable of storing energy from renewable sources. In 2025, investments in renewable energy infrastructure are projected to exceed $200 billion, which could lead to a corresponding increase in demand for automotive batteries. This trend suggests that the automotive battery market will benefit from the broader shift towards sustainable energy solutions.

Consumer Awareness and Education on Battery Technologies

Consumer awareness regarding battery technologies is playing a crucial role in shaping the automotive battery market. As individuals become more informed about the benefits of electric vehicles and the advancements in battery technologies, their purchasing decisions are increasingly influenced by this knowledge. Educational campaigns and marketing efforts by manufacturers are helping to demystify battery technologies, making them more accessible to the average consumer. This heightened awareness is likely to drive demand for electric vehicles, thereby positively impacting the automotive battery market. In 2025, it is anticipated that consumer education initiatives will contribute to a 15% increase in electric vehicle sales, further solidifying the automotive battery market's growth trajectory.