Shift Towards Sustainable Mobility

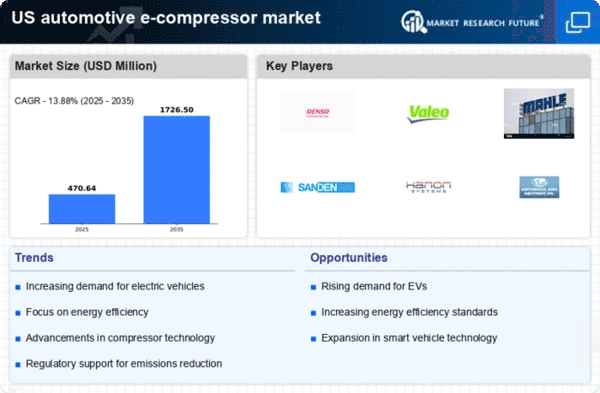

The automotive e-compressor market is experiencing a notable shift towards sustainable mobility solutions. As consumers increasingly prioritize eco-friendly vehicles, manufacturers are compelled to innovate. The demand for electric vehicles (EVs) is projected to rise, with estimates suggesting that EV sales could reach 30% of total vehicle sales in the US by 2030. This transition necessitates the integration of advanced e-compressor technologies, which enhance energy efficiency and reduce emissions. Consequently, the automotive e-compressor market is likely to expand as automakers seek to meet consumer expectations and regulatory standards for sustainability.

Enhanced Energy Efficiency Requirements

Energy efficiency is becoming a critical focus in the automotive e-compressor market. With rising fuel prices and growing environmental concerns, manufacturers are under pressure to develop more efficient systems. E-compressors, which utilize electric power instead of traditional belt-driven compressors, offer improved performance and reduced energy consumption. Reports indicate that e-compressors can enhance the overall efficiency of HVAC systems by up to 20%. As automakers strive to comply with stringent energy efficiency regulations, the demand for innovative e-compressor solutions is expected to surge, driving growth in the market.

Consumer Preference for Advanced Features

Consumer preferences are evolving, with a growing inclination towards vehicles equipped with advanced features. The automotive e-compressor market is benefiting from this trend, as e-compressors enable features such as rapid cabin cooling and improved climate control. As consumers demand more comfort and convenience, automakers are integrating e-compressors into their designs. Market analysis suggests that vehicles with enhanced climate control systems are likely to command a premium, potentially increasing the average selling price by 5-10%. This shift in consumer behavior is expected to drive the growth of the automotive e-compressor market.

Technological Integration in Vehicle Design

The automotive e-compressor market is significantly influenced by the integration of advanced technologies in vehicle design. Innovations such as smart climate control systems and variable speed compressors are becoming standard in modern vehicles. These technologies not only improve comfort but also optimize energy usage. The market for e-compressors is projected to grow as manufacturers increasingly adopt these technologies to enhance vehicle performance. By 2025, it is anticipated that nearly 50% of new vehicles will feature integrated e-compressor systems, reflecting a shift towards more sophisticated automotive engineering.

Government Incentives for Electric Vehicle Adoption

Government policies and incentives play a pivotal role in shaping the automotive e-compressor market. Various federal and state initiatives aim to promote electric vehicle adoption, including tax credits and rebates for EV buyers. These incentives are likely to stimulate demand for electric vehicles, which in turn drives the need for efficient e-compressor systems. As the US government continues to support the transition to electric mobility, the automotive e-compressor market is expected to expand, with projections indicating a potential market growth of 15% annually over the next five years.