Increased Investment in Automotive R&D

Increased investment in automotive research and development (R&D) is a key driver of the US Automotive Exhaust Sensors Market. As manufacturers strive to innovate and improve vehicle performance, they are allocating substantial resources to develop advanced exhaust sensor technologies. This trend is evident in the growing number of partnerships between automotive companies and technology firms aimed at enhancing sensor capabilities. In 2025, R&D spending in the automotive sector is expected to reach $20 billion, reflecting a commitment to innovation. This investment is likely to yield new sensor designs that improve accuracy, durability, and efficiency, thereby propelling market growth and ensuring compliance with evolving regulations.

Shift Towards Electric and Hybrid Vehicles

The shift towards electric and hybrid vehicles is reshaping the US Automotive Exhaust Sensors Market. As consumers increasingly opt for environmentally friendly transportation options, the demand for traditional exhaust sensors may decline. However, this transition also creates opportunities for new sensor technologies that monitor battery performance and energy efficiency in hybrid systems. The market is likely to adapt by developing sensors that cater to these emerging vehicle types. In 2025, electric vehicle sales in the US are projected to account for over 20% of total vehicle sales, indicating a significant shift that could redefine sensor requirements and applications within the industry.

Technological Advancements in Sensor Design

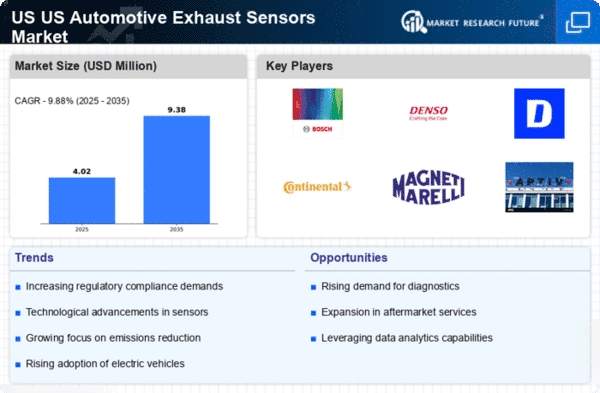

Technological advancements in sensor design are propelling the US Automotive Exhaust Sensors Market forward. Innovations such as the development of wideband oxygen sensors and improved temperature sensors enhance the accuracy and efficiency of exhaust systems. These advancements not only optimize engine performance but also contribute to lower emissions, aligning with regulatory demands. The market is expected to experience a compound annual growth rate (CAGR) of approximately 6% from 2025 to 2030, driven by these technological improvements. Furthermore, the integration of smart sensors with IoT capabilities is anticipated to revolutionize the industry, providing real-time data and analytics that can lead to better vehicle performance and compliance.

Regulatory Compliance and Emission Standards

The US Automotive Exhaust Sensors Market is significantly influenced by stringent regulatory compliance and emission standards set by the Environmental Protection Agency (EPA). These regulations mandate the reduction of harmful emissions from vehicles, compelling manufacturers to integrate advanced exhaust sensors. The market is projected to grow as automakers invest in technologies that ensure compliance with these standards. In 2025, the EPA proposed new regulations aimed at reducing nitrogen oxides and particulate matter, which could further drive the demand for sophisticated exhaust sensors. As a result, the industry is likely to witness an increase in sensor adoption to meet these evolving requirements, thereby enhancing the overall market landscape.

Growing Consumer Awareness of Environmental Issues

Growing consumer awareness of environmental issues is driving the US Automotive Exhaust Sensors Market. As public concern regarding air quality and climate change intensifies, consumers are increasingly demanding vehicles that minimize emissions. This trend compels manufacturers to invest in advanced exhaust sensor technologies that ensure compliance with environmental standards. In 2025, surveys indicate that over 70% of consumers prioritize eco-friendly features when purchasing vehicles, which could lead to a surge in demand for vehicles equipped with high-performance exhaust sensors. Consequently, the industry is likely to see a shift towards more sustainable practices and technologies, further enhancing market growth.