Rising Consumer Demand for Flexible Financing

The automotive finance market is experiencing a notable increase in consumer demand for flexible financing options. This trend is driven by a growing preference for personalized payment plans that cater to individual financial situations. As consumers seek to manage their budgets more effectively, the market has seen a shift towards tailored financing solutions, including variable interest rates and extended loan terms. In 2025, approximately 35% of new vehicle purchases are financed through flexible options, indicating a significant transformation in consumer behavior. This shift not only enhances customer satisfaction but also encourages dealerships to adapt their financing strategies, thereby impacting the overall automotive finance market.

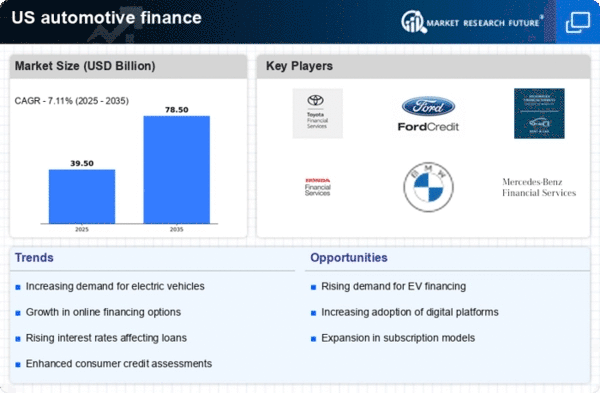

Growing Interest in Electric Vehicle Financing

The automotive finance market is increasingly influenced by the growing interest in electric vehicle (EV) financing. As consumers become more environmentally conscious, the demand for EVs is rising, prompting lenders to develop specialized financing products tailored to this segment. In 2025, it is estimated that EVs will represent 20% of new vehicle sales, leading to a corresponding increase in financing options for these vehicles. This trend not only supports the transition to sustainable transportation but also encourages financial institutions to innovate their offerings, thereby enhancing the overall automotive finance market.

Technological Advancements in Credit Assessment

Technological advancements are reshaping the credit assessment processes within the automotive finance market. The integration of artificial intelligence and machine learning algorithms allows lenders to evaluate creditworthiness more accurately and efficiently. This innovation reduces the time required for loan approvals and enhances the customer experience. In 2025, it is estimated that 60% of lenders utilize advanced analytics for credit assessments, streamlining the financing process. As a result, consumers benefit from quicker access to financing options, which may lead to increased vehicle sales and a more dynamic automotive finance market.

Regulatory Changes Impacting Financing Practices

Regulatory changes are playing a crucial role in shaping the automotive finance market. Recent legislation aimed at enhancing consumer protection has led to stricter guidelines for lenders, particularly concerning transparency in loan terms and interest rates. These regulations are designed to prevent predatory lending practices and ensure that consumers are fully informed before committing to financing agreements. As a result, the automotive finance market is adapting to comply with these new standards, which may lead to a more trustworthy environment for consumers. In 2025, compliance costs for lenders are expected to rise by 15%, influencing their operational strategies.

Increased Availability of Alternative Financing Sources

The automotive finance market is witnessing an increase in alternative financing sources, which diversifies the options available to consumers. Non-traditional lenders, including fintech companies, are entering the market, offering innovative financing solutions that challenge traditional banks. This influx of alternative financing options is particularly appealing to younger consumers who may prefer digital platforms for their transactions. In 2025, alternative lenders are projected to account for 25% of the automotive finance market, indicating a shift in how consumers approach vehicle financing. This trend encourages competition and may lead to more favorable terms for borrowers.