Top Industry Leaders in the US Automotive Industry Market

*Disclaimer: List of key companies in no particular order

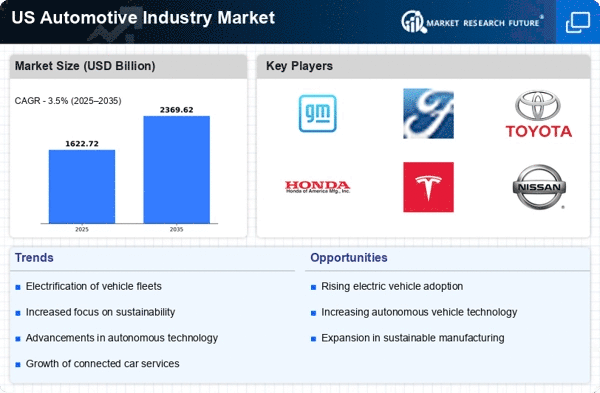

The US automotive industry, a behemoth valued at over $990 billion, is a complex ecosystem where established giants and nimble startups jostle for market share. Understanding the competitive landscape in this dynamic arena requires a keen eye on key player strategies, evolving market trends, and factors shaping the future of mobility.

Traditional Titans: Adapting to the Evolving Terrain

Detroit's Big Three – General Motors (GM), Ford, and Chrysler – have long dominated the US market. However, they face a dual challenge: adapting to shifting consumer preferences for fuel efficiency and alternative powertrains while navigating the complexities of global supply chains. GM, for example, is betting big on electric vehicles (EVs) with its Ultium platform and Chevrolet Bolt, while Ford is investing in hybrids and plug-in hybrids alongside its Mustang Mach-E electric SUV. Chrysler, meanwhile, leverages its Jeep brand's off-road prowess and is exploring electrification options.

Foreign Forays: Innovation and Expansion

European and Asian automakers have established a strong presence in the US market, offering a diverse range of vehicles and fuel options. Toyota, the world's largest automaker, holds a significant share with its fuel-efficient hybrids and growing EV lineup. Volkswagen Group, with brands like Audi and Porsche, caters to the luxury segment, while Hyundai and Kia are gaining traction with their affordable and feature-packed cars. These foreign players are constantly innovating and expanding their product portfolios to cater to evolving consumer demands.

Emerging Disruptors: Redefining the Ride

The automotive landscape is being reshaped by a new breed of players – tech giants and startups – who are challenging the traditional model with innovative technologies and disruptive business models. Tesla, the poster child of the EV revolution, has redefined the luxury car segment with its high-performance vehicles and extensive charging network. Other startups like Rivian and Lucid Motors are entering the fray with premium electric trucks and SUVs. Meanwhile, tech giants like Apple and Google are developing autonomous driving technologies that could revolutionize the industry.

Factors Shaping the Competitive Landscape

Market share analysis in the US automotive industry is influenced by a multitude of factors:

• Vehicle Segment: Light trucks, including SUVs and pickups, dominate the market, while passenger cars are on a decline.

• Fuel Efficiency and Emissions: Stringent regulations and rising fuel costs are driving demand for fuel-efficient vehicles and EVs.

• Technology Adoption: Advanced driver-assistance systems (ADAS) and autonomous driving technologies are becoming increasingly popular.

• Brand Loyalty and Customer Preferences: Consumer preferences for brand, design, features, and price play a significant role in market share.

• Global Supply Chain: Disruptions in global supply chains, particularly chip shortages, can impact production and availability of vehicles.

New and Emerging Trends: Gearing for the Future

The US automotive industry is undergoing a period of transformative change, with several key trends shaping the future:

• Electric Vehicle Boom: EV sales are expected to soar in the coming years, driven by government incentives, falling battery costs, and expanding charging infrastructure.

• Connected and Autonomous Vehicles: The integration of connected car technologies and the development of autonomous driving systems will reshape the driving experience and redefine ownership models.

• Subscription Services: Innovative car subscription services are gaining traction, offering flexible ownership options and catering to changing consumer preferences.

• Personalization and Customization: Manufacturers are increasingly offering customization options to cater to individual preferences and create a more personalized driving experience.

Top listed companies in the US Automotive Industry industry are:

GM

AM General

Toyota

Callaway Cars

Equus Automotive

Renault

Hyundai Motor Group

Ford

FCA

Honda

Tesla

Detroit Three

Chrysler LLC

Builk

GMC

Jeep

Monro Inc.

Firestone Complete Auto Care

Jiffy Lube International, Inc.

Midas International, LLC

Meineke Car Care Centers, LLC.

The Competitive Road Ahead: Navigating the Curves

The future of the US automotive industry is uncertain but filled with exciting possibilities. Success for established players and new entrants alike will depend on their ability to adapt to changing market dynamics, embrace innovation, and cater to evolving consumer preferences. Those who can navigate the curves of the competitive landscape – from the rise of EVs to the integration of new technologies – will be the ones who steer the industry forward.

Latest Company Updates:

GM: Investing heavily in EVs and autonomous vehicles, with plans to launch 30 new EVs by 2025. Recently announced a partnership with LG Energy Solution to build a battery factory in Indiana.

AM General: Expanding its military vehicle business and exploring new commercial applications for its Hummer brand.

Toyota: Launching several new electric and hybrid models, including the bZ4X SUV and the Corolla Cross Hybrid. Pledged to invest $35 billion in battery production and development by 2030.

Callaway Cars: Partnering with General Motors to develop high-performance versions of the Chevrolet Corvette and Silverado.