Growing Automotive Production

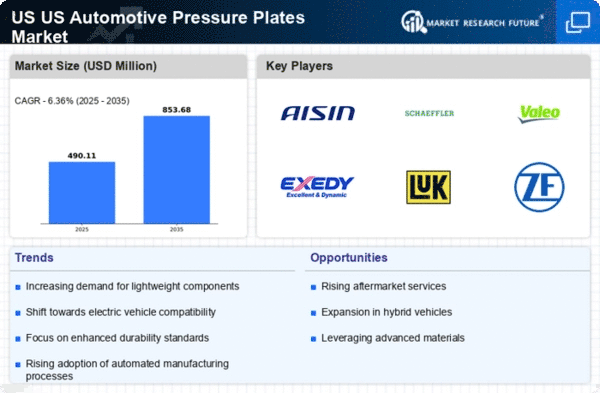

The US Automotive Pressure Plates Market is experiencing growth driven by the increasing production of vehicles in the United States. In 2025, the automotive sector produced approximately 10 million vehicles, reflecting a steady demand for pressure plates. This surge in production is attributed to the rising consumer preference for personal vehicles, as well as the expansion of electric vehicle (EV) manufacturing. As automakers ramp up production to meet consumer demand, the need for high-quality pressure plates becomes paramount. Consequently, manufacturers are likely to invest in advanced technologies and materials to enhance the performance and durability of pressure plates, thereby supporting the overall growth of the US Automotive Pressure Plates Market.

Expansion of Aftermarket Services

The expansion of aftermarket services is emerging as a significant driver for the US Automotive Pressure Plates Market. As vehicle ownership increases, the demand for replacement parts, including pressure plates, is also on the rise. In 2025, the aftermarket segment is projected to account for approximately 40% of the total market share. This growth is fueled by the increasing average age of vehicles on the road, leading to a higher likelihood of component replacements. Consequently, manufacturers and suppliers are likely to enhance their distribution networks and service offerings to cater to this growing demand, thereby bolstering the US Automotive Pressure Plates Market.

Rising Demand for Electric Vehicles

The increasing demand for electric vehicles (EVs) is reshaping the US Automotive Pressure Plates Market. As consumers become more environmentally conscious, the shift towards EVs is evident, with sales projected to reach 3 million units by 2026. This transition necessitates the development of specialized pressure plates that can accommodate the unique requirements of electric drivetrains. Manufacturers are likely to focus on creating lightweight and high-performance pressure plates to enhance the efficiency of EVs. Consequently, the US Automotive Pressure Plates Market is expected to adapt to these changes, fostering innovation and new product development tailored to the evolving automotive landscape.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards play a crucial role in shaping the US Automotive Pressure Plates Market. The National Highway Traffic Safety Administration (NHTSA) enforces stringent regulations regarding vehicle safety, which directly impacts the design and manufacturing of pressure plates. In 2025, compliance with these regulations is expected to drive manufacturers to enhance the quality and reliability of their products. This focus on safety not only ensures consumer protection but also fosters trust in automotive brands. As a result, the US Automotive Pressure Plates Market is likely to see increased investments in research and development to meet these evolving safety standards.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are significantly influencing the US Automotive Pressure Plates Market. Innovations such as computer-aided design (CAD) and computer numerical control (CNC) machining have improved the precision and efficiency of pressure plate production. In 2025, it is estimated that around 30% of pressure plates are produced using advanced manufacturing techniques, which enhance product quality and reduce waste. Furthermore, the integration of automation in production lines is expected to streamline operations, leading to cost savings and faster turnaround times. As manufacturers adopt these technologies, the US Automotive Pressure Plates Market is likely to witness enhanced competitiveness and product offerings.