Operational Efficiency and Cost Reduction

In the aviation crew-management-systems market, the pursuit of operational efficiency and cost reduction remains a primary driver. Airlines are increasingly adopting sophisticated crew management systems to streamline operations, reduce labor costs, and enhance productivity. By automating scheduling, tracking, and compliance processes, these systems can lead to a reduction in operational costs by up to 15%. Furthermore, the ability to analyze crew performance data allows airlines to make informed decisions that optimize crew utilization. As competition intensifies within the aviation sector, the demand for solutions that enhance operational efficiency is likely to grow, propelling the aviation crew-management-systems market forward. The focus on cost-effective solutions is expected to drive innovation and investment in this sector.

Technological Advancements and Innovation

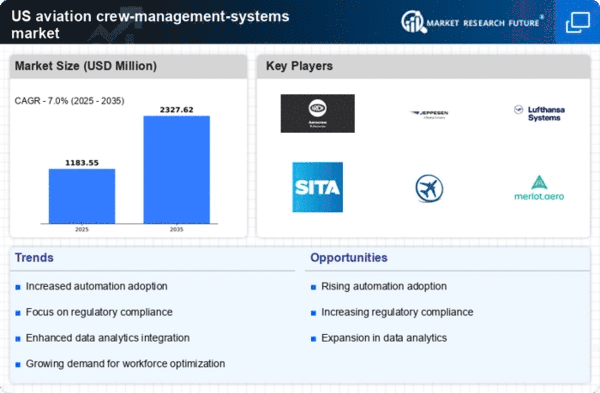

Technological advancements play a pivotal role in shaping the aviation crew-management-systems market. The integration of artificial intelligence (AI), machine learning, and data analytics into crew management solutions is transforming how airlines operate. These technologies enable predictive analytics for crew scheduling, which can enhance operational efficiency and reduce delays. As of 2025, the market is witnessing a surge in demand for innovative solutions that leverage these technologies, with a projected growth rate of 10% annually. Airlines are increasingly seeking systems that not only manage crew schedules but also provide insights into performance metrics and operational trends. This drive for innovation is likely to propel the aviation crew-management-systems market to new heights.

Regulatory Compliance and Safety Standards

The aviation crew-management-systems market is significantly influenced by the stringent regulatory compliance and safety standards imposed by the Federal Aviation Administration (FAA) and other governing bodies. These regulations necessitate that airlines and operators maintain high levels of operational efficiency and safety, which in turn drives the demand for advanced crew management solutions. As of 2025, the FAA has increased its focus on safety oversight, leading to a projected growth of 8% in the market as companies seek to ensure compliance. The need for real-time data and reporting capabilities in crew management systems is paramount, as it allows operators to adhere to these regulations while optimizing crew scheduling and reducing operational costs. Thus, the emphasis on regulatory compliance is a key driver in the aviation crew-management-systems market.

Workforce Management and Employee Satisfaction

The aviation crew-management-systems market is increasingly driven by the need for effective workforce management and employee satisfaction. Airlines recognize that a satisfied and well-managed crew can lead to improved service quality and operational performance. As of 2025, studies indicate that employee satisfaction directly correlates with customer satisfaction, which is crucial in the competitive aviation landscape. Advanced crew management systems facilitate better communication, scheduling flexibility, and training opportunities, which can enhance crew morale. Consequently, airlines are investing in these systems to foster a positive work environment, thereby reducing turnover rates and associated training costs. This focus on workforce management is a significant factor influencing the growth of the aviation crew-management-systems market.

Increased Demand for Flexible Scheduling Solutions

The aviation crew-management-systems market is experiencing a notable increase in demand for flexible scheduling solutions. As airlines adapt to changing travel patterns and fluctuating passenger demand, the need for agile crew management systems becomes paramount. Flexibility in scheduling allows airlines to respond swiftly to operational challenges, such as last-minute flight changes or crew shortages. In 2025, it is estimated that the demand for flexible scheduling capabilities will contribute to a 12% growth in the market. This trend is further fueled by the desire to enhance crew work-life balance, which can lead to improved job satisfaction and retention rates. Consequently, the emphasis on flexible scheduling solutions is a critical driver in the aviation crew-management-systems market.