Aging Population

The aging population in the US is contributing to the growth of the bariatric surgery market. Older adults are increasingly facing obesity-related health challenges, which can lead to a decline in quality of life. As the population ages, the demand for effective weight loss solutions, including bariatric surgery, is likely to rise. According to the US Census Bureau, the number of adults aged 65 and older is projected to reach 80 million by 2040. This demographic shift suggests that more older adults may seek surgical interventions to improve their health and mobility. Consequently, the bariatric surgery market may see a significant increase in patients from this age group.

Rising Obesity Rates

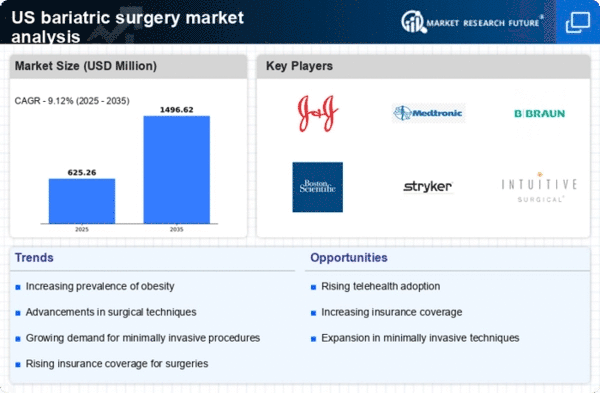

The increasing prevalence of obesity in the US is a primary driver of the bariatric surgery market. According to the CDC, approximately 42.4% of adults were classified as obese in 2017-2018, a figure that has likely risen in subsequent years. This alarming trend is prompting healthcare providers to seek effective solutions, with bariatric surgery being one of the most effective long-term weight loss options. the market is expected to grow as more individuals seek surgical interventions to combat obesity-related health issues, such as diabetes and cardiovascular diseases. The demand for surgical procedures is further fueled by the growing awareness of the health risks associated with obesity, leading to increased consultations and referrals for bariatric surgery.

Technological Advancements

Innovations in surgical techniques and technologies are significantly impacting the bariatric surgery market. The introduction of robotic-assisted surgeries and advanced laparoscopic techniques has improved surgical outcomes, reduced recovery times, and minimized complications. These advancements not only enhance patient safety but also increase the efficiency of surgical procedures. As hospitals and surgical centers adopt these technologies, the bariatric surgery market is likely to experience growth. Furthermore, the development of new devices and tools tailored for bariatric procedures may attract more patients seeking effective weight loss solutions. The integration of technology into surgical practices is expected to play a crucial role in shaping the future of the bariatric surgery market.

Insurance Coverage Improvements

Improvements in insurance coverage for bariatric surgery are likely to drive market growth. Many insurance providers are expanding their coverage policies to include bariatric procedures, recognizing the long-term cost savings associated with treating obesity-related conditions. This shift in policy is making surgery more accessible to a broader range of patients, thereby increasing the number of individuals who can afford the procedure. As more patients gain access to insurance coverage for bariatric surgery, the market is expected to experience a surge in demand. This trend indicates a positive outlook for the bariatric surgery market, as financial barriers are reduced and more patients seek surgical options for weight management.

Increased Awareness and Education

There is a growing awareness of the benefits of bariatric surgery among both patients and healthcare providers. Educational campaigns and outreach programs are helping to inform the public about the effectiveness of surgical weight loss options. This increased awareness is likely to drive demand for bariatric procedures, as more individuals recognize the potential for improved health outcomes. Additionally, healthcare providers are becoming more knowledgeable about the advantages of referring patients for surgical interventions. As a result, the bariatric surgery market is expected to expand as more patients seek consultations and consider surgery as a viable option for weight management.