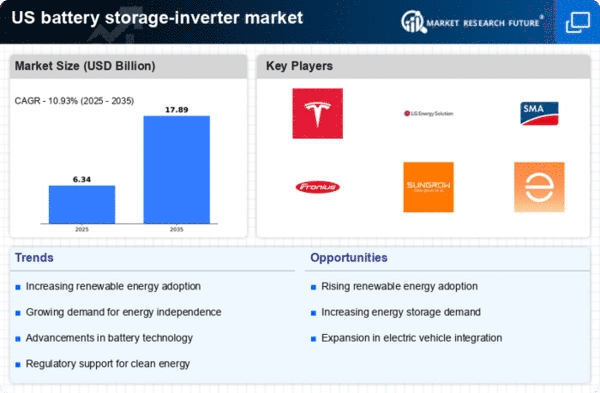

The battery storage-inverter market is currently characterized by a dynamic competitive landscape, driven by increasing demand for renewable energy solutions and advancements in energy storage technologies. Key players such as Tesla (US), Enphase Energy (US), and LG Energy Solution (KR) are strategically positioned to leverage innovation and partnerships to enhance their market presence. Tesla (US) continues to focus on integrating its energy products with its electric vehicle offerings, thereby creating a comprehensive ecosystem that appeals to environmentally conscious consumers. Meanwhile, Enphase Energy (US) emphasizes its microinverter technology, which enhances energy efficiency and system reliability, positioning itself as a leader in residential solar solutions. LG Energy Solution (KR) is actively expanding its production capabilities in North America, aiming to meet the growing demand for battery storage systems, which collectively shapes a competitive environment that is increasingly focused on technological advancement and customer-centric solutions. In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to mitigate risks and enhance responsiveness to market demands. The market structure appears moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for a diverse range of products and services, fostering innovation while also creating competitive pressures that drive companies to differentiate themselves through technology and service offerings. In October 2025, Tesla (US) announced the launch of its new energy storage product, the Powerwall 3, which features enhanced battery capacity and integration capabilities with solar systems. This strategic move is significant as it not only strengthens Tesla's position in the residential energy storage market but also aligns with the growing trend of energy independence among consumers. The introduction of this product is likely to attract a broader customer base, particularly those seeking sustainable energy solutions. In September 2025, Enphase Energy (US) expanded its partnership with a major utility provider to integrate its microinverter technology into large-scale solar projects. This collaboration is indicative of Enphase's strategy to penetrate the utility-scale market, which could potentially increase its market share and enhance its reputation as a reliable technology provider. Such partnerships are crucial in a landscape where utility companies are increasingly looking for innovative solutions to meet renewable energy targets. In August 2025, LG Energy Solution (KR) announced a significant investment in a new battery manufacturing facility in the US, aimed at increasing production capacity for its energy storage systems. This investment underscores LG's commitment to the North American market and its strategy to capitalize on the growing demand for energy storage solutions. By enhancing local production capabilities, LG is likely to improve its supply chain efficiency and reduce lead times, which are critical factors in maintaining competitiveness in this rapidly evolving market. As of November 2025, current competitive trends are heavily influenced by digitalization, sustainability, and the integration of AI technologies into energy management systems. Strategic alliances among key players are shaping the landscape, fostering innovation and collaboration that drive advancements in energy storage solutions. The competitive differentiation is expected to evolve from traditional price-based competition towards a focus on innovation, technological superiority, and supply chain reliability. Companies that can effectively leverage these trends are likely to emerge as leaders in the battery storage-inverter market.