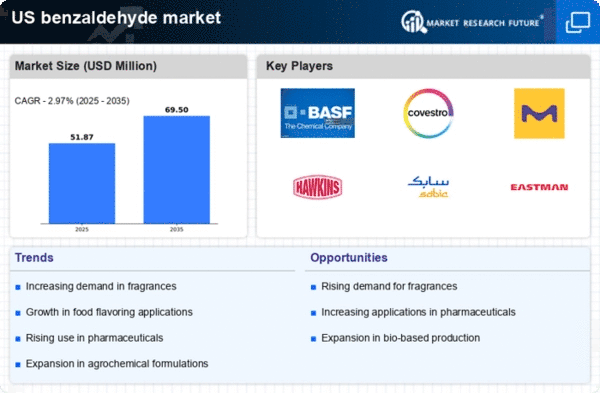

The benzaldehyde market exhibits a competitive landscape characterized by a blend of established players and emerging companies, driven by factors such as increasing demand in the fragrance and flavor industries, as well as its applications in pharmaceuticals and agrochemicals. Key players like BASF SE (DE), Eastman Chemical Company (US), and Hawkins Inc (US) are strategically positioned to leverage their extensive product portfolios and innovation capabilities. BASF SE (DE) focuses on sustainable production methods, while Eastman Chemical Company (US) emphasizes digital transformation to enhance operational efficiency. Hawkins Inc (US) is expanding its regional presence, which collectively shapes a competitive environment that is both dynamic and responsive to market needs.The market structure appears moderately fragmented, with several players vying for market share through localized manufacturing and optimized supply chains. This fragmentation allows for a diverse range of products and services, catering to various customer needs. The collective influence of these key players fosters a competitive atmosphere where innovation and customer-centric strategies are paramount, enabling them to adapt to changing market conditions effectively.

In October BASF SE (DE) announced the launch of a new line of bio-based benzaldehyde products, aiming to meet the growing demand for sustainable chemicals. This strategic move not only enhances their product offerings but also aligns with global sustainability trends, potentially positioning BASF as a leader in eco-friendly solutions within the market. The introduction of these products may attract environmentally conscious consumers and businesses, thereby expanding their market reach.

In September Eastman Chemical Company (US) unveiled a digital platform designed to streamline its supply chain processes, enhancing transparency and efficiency. This initiative reflects a broader trend towards digitalization in the chemical industry, suggesting that Eastman is keen on leveraging technology to improve operational performance. The platform is expected to facilitate better inventory management and customer service, which could lead to increased customer loyalty and market competitiveness.

In August Hawkins Inc (US) completed the acquisition of a regional distributor, significantly bolstering its distribution capabilities in the Midwest. This acquisition is likely to enhance Hawkins' market presence and operational efficiency, allowing for quicker response times to customer demands. Such strategic expansions indicate a trend towards consolidation in the market, where companies seek to strengthen their foothold through acquisitions and partnerships.

As of November the competitive trends in the benzaldehyde market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, enabling companies to pool resources and expertise to innovate more effectively. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to adapt to these evolving trends.