Market Analysis

In-depth Analysis of US Bio-based surfactants Market Industry Landscape

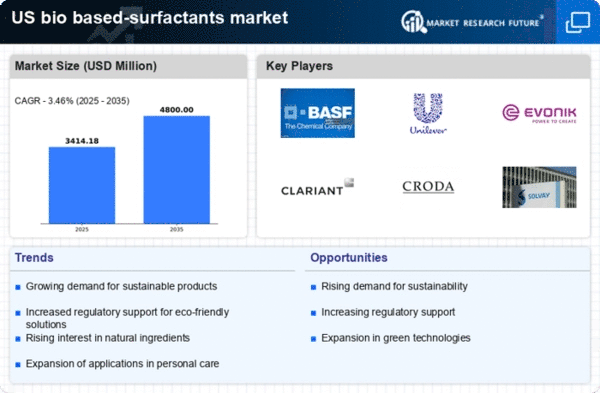

The current US market for bio-based surfactants is in transition due to a combination of environmental consciousness, regulatory trends and demand for sustainable alternatives in consumer goods and industry. Surfactants which are important ingredients in various products like detergents, personal care items, and agricultural formulations have traditionally been sourced from petrochemicals. However, recent concerns over the environment and efforts to reduce dependence on fossil fuels have propelled the growth of the bio-based surfactant market.

One of these market dynamics is the growing awareness and need for eco-friendly products. In America as consumers become more concerned with their environmental impact prompting producers to look for ecological options. Bio-based surfactants, which are frequently derived from renewable resources such as plant oils provide consumers with a greener choice conforming with their preference of environmentally friendly goods. This shift in consumer behavior affects market drivers thus motivating companies to invest research into bio-based surfactants that will range within sustainability limits.

In addition, regulation drives regarding sustainability objectives that exist in United States also influence market dynamics of bio-based surfactants. These rules set by governments targeting reduced carbon emissions along with use of eco-friendly components in manufacture of commodities creates a favorable environment for growth of biobased surfactants. The enterprises involved meet these regulations through incorporating biodegradable alternatives into their formulations thereby promoting growth on an overall basis.

Furthermore, the agricultural industry plays a significant role in shaping market dynamics. Bio-based surfactants are utilized within agrochemical formulations to increase efficacy of pesticides and herbicides. The demand for biobased surfactant has gone up with increasing emphasis on sustainable agriculture or organic farming practices influencing market dynamic where new opportunities arise in agriculture segment.

Market forces related to bio-based surfactants are shaped by partnerships within this sector. Collaborations among firms are aimed at boosting production capacities along sharing research ideas plus addressing problems such as scalability and cost effectiveness together. This helps to grow the market as a whole through such alliances that foster innovation and easier integration of biobased surfactants into a wider range of uses.

Cost effectiveness and scalability are other issues that determine market dynamics in this field. Though the need for sustainable solutions is on the rise, the cost of production and upscaling bio-based surfactant manufacturing processes pose challenges. These obstacles need to be overcome so as to make bio-based surfactants economically viable alternative to traditional ones and become more widely accepted in the market.

The recent developments in technology and consistent research activities also drive innovation within the bio-based surfactants industry. Newer means through which various efficacious methods for producing less expensive and environmentally-friendly surfactants from renewable sources have been developed have been introduced thus changing dynamics of markets over time. Thus, these developments not only fuel growth within the market but also pave way for different applications related to bio-based surfactants.

Other issues affecting market dynamics pertain education being provided about them. Despite growing popularity of biobased surfactants, campaigns aimed at educating consumers, manufacturers or industries regarding benefits plus areas where they can substitute conventional ones remain necessary. The more we know about these substances, therefore, faster its adoption would take place hence effecting positive changes in our markets’s behavior.

Leave a Comment