Market Share

US Bio-based surfactants Market Share Analysis

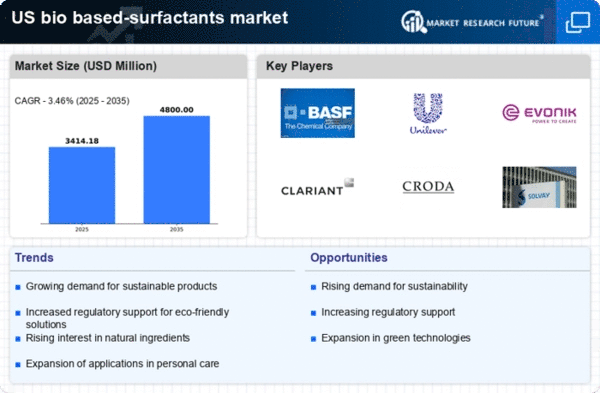

As sustainability and environmental consciousness become important factors in consumer and corporate decision-making, the US Bio-based Surfactants Market is witnessing a growing attention and growth. In its operations, this market uses various strategies to position itself for competitive advantage in a rapidly changing industry. One of these strategies is heavily focused on innovation of the product. The companies are putting their money into research and development towards bio-surfactants that will perform highly with minimal damage on the environment. Their aim is to develop substitutes to traditional petroleum-derived surfactants, hence appealing to environmentally aware customers while setting themselves apart as industry leaders.

Cost leadership is another major market share positioning strategy in the US Bio-based Surfactants Market. To make sure that their products can be afforded by customers, companies are engaged in optimizing production processes which have led to reduced manufacturing costs. This makes them able to sell bio-based surfactants cheaper thus reaching more consumer segments. As such, firms achieving a balance between being sustainable and affordable have a potential for capturing larger shares of markets because cost-effectiveness serves as an important factor influencing market entry.

Collaboration and partnerships with various stakeholders play a vital role in determining company positioning on the US Bio-based Surfactants Market. A partnership with raw material suppliers, research institutes and regulatory authorities help companies build strong supply chains, improve product development capabilities and ensure compliance with environmental regulations respectively. These kinds of alliances foster forward movement among bio-based surfactant technologies but also create positive brand image consequently earn trust from consumers as well as stakeholders.

Geographical expansion is another aspect that defines how players within the US Bio-based Surfactants Market take up their market shares. Due to emphasis on sustainable practices across industries, businesses are strategically venturing into different regions through establishing manufacturing units as well as distribution channels. This responds not only to increased demand for bio-surfactants but also to positioning the firms as contributors towards national and global sustainability goals in general.

Another strategy adopted by market players in the US Bio-based Surfactants Market is through educational and awareness campaigns. Companies are aware that consumer education is a key component of this sector, leading to initiatives aimed at sensitizing customers, local businesses as well as regulatory bodies on the importance of biobased surfactants in minimizing environmental pollution. Establishing a strong market presence and advocating for sustainable practices within different industries can be achieved through participation in such educational campaigns.

Further, technology adoption and innovation are important aspects of how companies position themselves in the US Bio-based Surfactants Market. Most firms are investing into emerging technologies that will enhance efficiency during production of bio-surfactant while improving their performance characteristics and widening applications range. These advancements go a long way in enhancing competitiveness of bio-surfactants but also provide room for more innovations in green chemistry.

Leave a Comment