Growing Health Consciousness

The increasing awareness of health and wellness among consumers is driving the bioactive ingredients market. As individuals become more health-conscious, they seek products that offer functional benefits, such as improved immunity and enhanced cognitive function. This trend is reflected in the rising demand for dietary supplements and functional foods, which incorporate bioactive ingredients. According to recent data, the market for dietary supplements in the US is projected to reach approximately $50 billion by 2026, indicating a robust growth trajectory. This shift towards preventive healthcare is likely to propel the bioactive ingredients market, as consumers prioritize products that contribute to their overall well-being.

Rising Popularity of Plant-Based Diets

The shift towards plant-based diets is significantly impacting the bioactive ingredients market. As more consumers adopt vegetarian and vegan lifestyles, the demand for plant-derived bioactive compounds is surging. These ingredients are often associated with various health benefits, including anti-inflammatory and antioxidant properties. Market Research Future indicates that the plant-based food market in the US is expected to exceed $74 billion by 2027, which suggests a growing consumer preference for plant-based options. This trend not only enhances the appeal of bioactive ingredients but also encourages manufacturers to explore innovative formulations that cater to this expanding demographic.

Regulatory Support for Natural Products

Regulatory frameworks in the US are increasingly supportive of natural products, which is beneficial for the bioactive ingredients market. Agencies such as the FDA have established guidelines that facilitate the approval and use of bioactive compounds in food and dietary supplements. This regulatory environment encourages innovation and investment in the development of new bioactive ingredients. Furthermore, the growing trend towards clean labeling and transparency in ingredient sourcing aligns with regulatory initiatives, fostering consumer trust. As a result, companies are more inclined to invest in bioactive ingredients, anticipating a favorable market response.

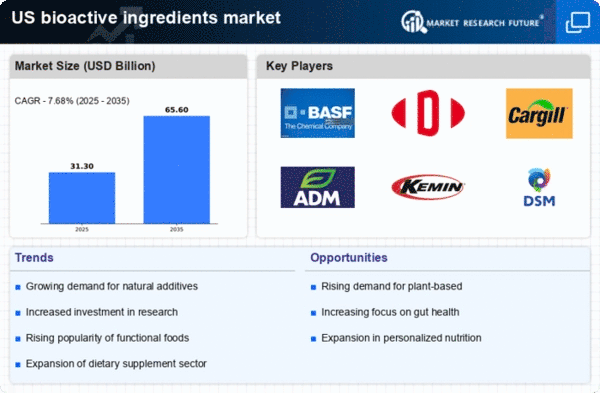

Increased Investment in Research and Development

Investment in research and development (R&D) is a key driver of growth in the bioactive ingredients market. Companies are increasingly allocating resources to explore the health benefits and applications of bioactive compounds. This focus on R&D is essential for developing innovative products that meet evolving consumer preferences. Recent statistics indicate that the US food and beverage industry invests over $1 billion annually in R&D, highlighting the commitment to advancing bioactive ingredient applications. This investment not only fosters innovation but also enhances the credibility of bioactive ingredients, as scientific validation becomes increasingly important to consumers.

Technological Innovations in Product Development

Technological advancements in product development are playing a crucial role in the bioactive ingredients market. Innovations in extraction and processing techniques enable manufacturers to enhance the efficacy and bioavailability of bioactive compounds. For instance, novel extraction methods such as supercritical fluid extraction and enzymatic processes are gaining traction, allowing for the efficient isolation of bioactive ingredients from natural sources. This technological evolution is likely to lead to the introduction of new products that meet consumer demands for quality and effectiveness. As a result, companies that leverage these technologies may gain a competitive edge in the bioactive ingredients market.