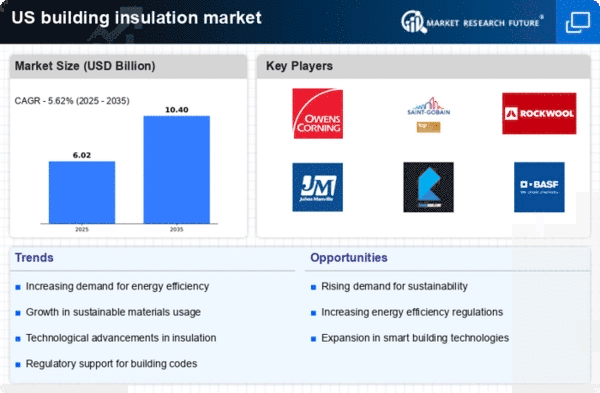

The building insulation-material market in the US is characterized by a dynamic competitive landscape, driven by increasing energy efficiency regulations and a growing emphasis on sustainable construction practices. Major players such as Owens Corning (US), Saint-Gobain (FR), and Rockwool International (DK) are strategically positioned to leverage innovation and sustainability in their operations. Owens Corning (US) focuses on developing advanced insulation solutions that enhance energy efficiency, while Saint-Gobain (FR) emphasizes its commitment to sustainable building materials. Rockwool International (DK) is also notable for its focus on fire-resistant insulation products, which aligns with current safety regulations. Collectively, these strategies contribute to a competitive environment that prioritizes innovation and sustainability.Key business tactics within the market include localizing manufacturing and optimizing supply chains to enhance responsiveness to regional demands. The competitive structure appears moderately fragmented, with several key players holding substantial market shares. This fragmentation allows for a diverse range of products and innovations, although the influence of major companies remains significant in shaping market trends and consumer preferences.

In October Owens Corning (US) announced the launch of a new line of eco-friendly insulation products designed to reduce carbon emissions during production. This strategic move not only aligns with the growing demand for sustainable building materials but also positions the company as a leader in eco-innovation within the insulation sector. The introduction of these products is likely to enhance Owens Corning's market share and appeal to environmentally conscious consumers.

In September Saint-Gobain (FR) expanded its manufacturing capabilities in the US by investing $50 million in a new facility dedicated to producing high-performance insulation materials. This expansion reflects the company's commitment to meeting increasing demand and underscores its strategy of regional growth. By enhancing its production capacity, Saint-Gobain (FR) is poised to strengthen its competitive position and respond more effectively to market needs.

In August Rockwool International (DK) entered into a strategic partnership with a leading construction firm to develop innovative insulation solutions tailored for commercial buildings. This collaboration is indicative of Rockwool's strategy to integrate its products into larger construction projects, thereby enhancing its visibility and market penetration. Such partnerships may facilitate the adoption of advanced insulation technologies in the commercial sector, further solidifying Rockwool's market presence.

As of November current competitive trends in the building insulation-material market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and enhancing product offerings. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident. Moving forward, competitive differentiation is likely to evolve, with companies that prioritize innovation and sustainability gaining a distinct advantage in the market.