Market Growth Projections

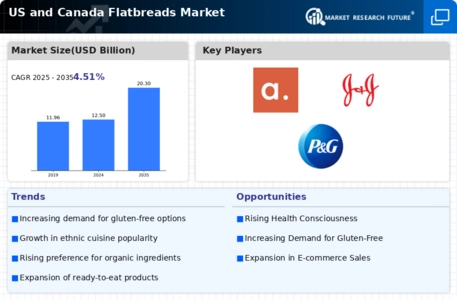

The Global US and Canada Flatbreads Market Industry is poised for substantial growth, with projections indicating a market size of 12.5 USD Billion in 2024 and an anticipated increase to 20.3 USD Billion by 2035. This growth trajectory suggests a robust demand for flatbreads, driven by various factors such as changing consumer preferences and the expansion of the foodservice sector. The market is expected to experience a CAGR of 4.51% from 2025 to 2035, reflecting the ongoing evolution of consumer tastes and the adaptability of flatbread products to meet these demands.

Growth of the Foodservice Sector

The expansion of the foodservice sector significantly impacts the Global US and Canada Flatbreads Market Industry. With the rise of casual dining and fast-casual restaurants, flatbreads are increasingly featured on menus as versatile and appealing options. Their ability to be customized with various toppings and fillings makes them a popular choice among consumers. As the foodservice industry continues to evolve, flatbreads are likely to gain further prominence, contributing to the market's growth. The increasing number of dining establishments and the trend towards experiential dining suggest a favorable environment for flatbread offerings.

Innovations in Flatbread Production

Innovations in flatbread production techniques are transforming the Global US and Canada Flatbreads Market Industry. Advances in technology and manufacturing processes enable producers to create a wider variety of flatbreads, including those with unique flavors and textures. This innovation not only enhances product quality but also caters to evolving consumer preferences for artisanal and gourmet options. As the market adapts to these changes, it is expected to attract a diverse consumer base. The ongoing emphasis on sustainability in production methods may further bolster the market, aligning with consumers' growing environmental concerns.

Rising Demand for Convenience Foods

The Global US and Canada Flatbreads Market Industry experiences a notable surge in demand for convenience foods, driven by busy lifestyles and the need for quick meal solutions. Flatbreads, being versatile and easy to prepare, fit seamlessly into this trend. In 2024, the market is projected to reach 12.5 USD Billion, reflecting consumers' preference for ready-to-eat options. This demand is likely to continue growing as more individuals seek convenient yet nutritious meal alternatives. The flatbread's adaptability in various cuisines further enhances its appeal, making it a staple in households across North America.

Cultural Diversity and Globalization

Cultural diversity and globalization play a pivotal role in shaping the Global US and Canada Flatbreads Market Industry. As populations become more multicultural, the demand for diverse culinary experiences increases. Flatbreads, which are integral to various cuisines, are increasingly embraced by consumers seeking authentic flavors. This trend is evidenced by the rising popularity of Mediterranean, Indian, and Middle Eastern flatbreads in North America. The market's anticipated CAGR of 4.51% from 2025 to 2035 indicates that this cultural exchange is likely to foster innovation and expansion within the flatbread segment, appealing to a broader audience.

Health Consciousness Among Consumers

Increasing health consciousness among consumers significantly influences the Global US and Canada Flatbreads Market Industry. As individuals become more aware of their dietary choices, there is a growing preference for healthier options, including whole grain and gluten-free flatbreads. This shift is indicative of a broader trend towards clean eating and nutritional awareness. The market's projected growth to 20.3 USD Billion by 2035 suggests that manufacturers are likely to innovate and diversify their product offerings to cater to this health-oriented demographic. Consequently, flatbreads that emphasize natural ingredients and health benefits are expected to gain traction.