Rising Incidence of Cancer

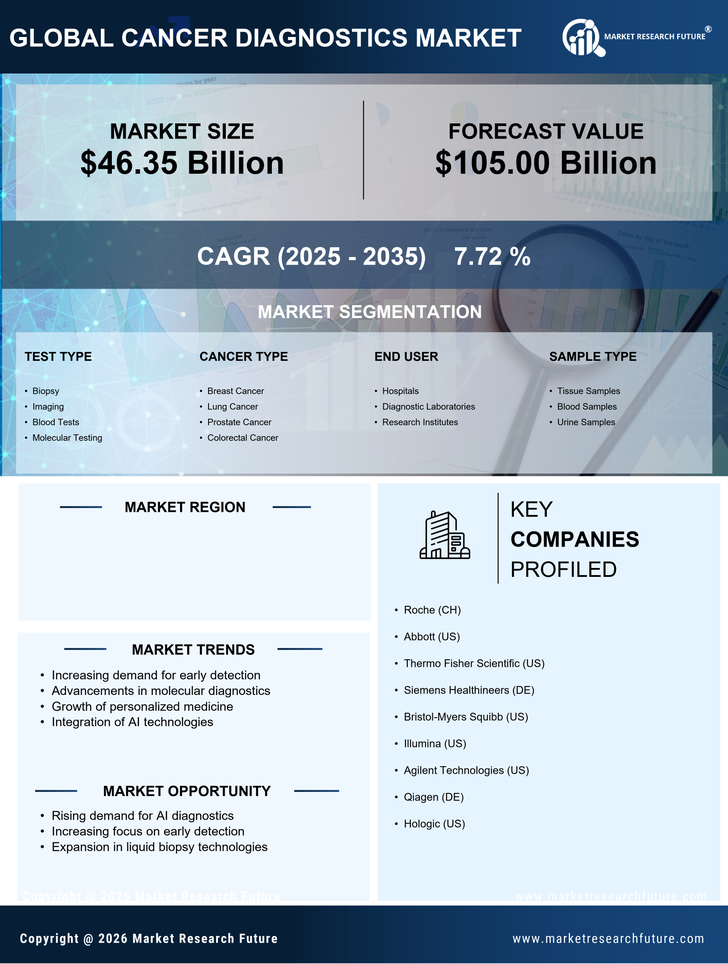

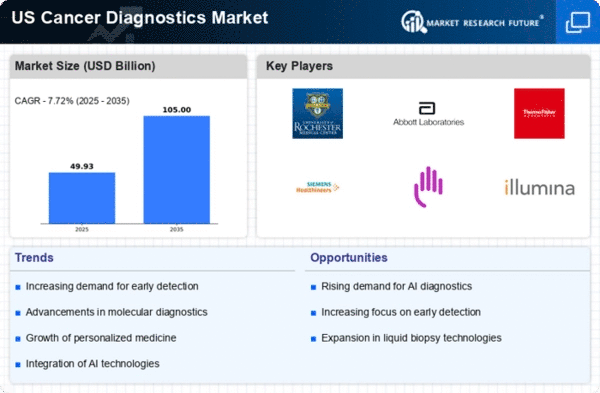

The increasing incidence of cancer in the US is a primary driver for the cancer diagnostics market. According to the American Cancer Society, approximately 1.9 million new cancer cases are expected to be diagnosed in 2025. This alarming trend necessitates the development and adoption of advanced diagnostic tools to facilitate early detection and improve patient outcomes. As the population ages, the demand for effective cancer diagnostics is likely to rise, prompting healthcare providers to invest in innovative technologies. The cancer diagnostics market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 7.5% from 2025 to 2030. This growth is driven by the urgent need for accurate and timely cancer detection methods, which are essential for effective treatment planning.

Government Initiatives and Funding

Government initiatives aimed at improving cancer care significantly impact the cancer diagnostics market. The National Cancer Institute (NCI) and other federal agencies have increased funding for cancer research and diagnostic innovation. In 2025, the NCI's budget is projected to exceed $6 billion, with a substantial portion allocated to developing new diagnostic tools and technologies. These initiatives not only foster innovation but also encourage collaboration between public and private sectors, leading to the rapid advancement of diagnostic solutions. Furthermore, the establishment of programs that promote early detection and screening is likely to enhance the overall effectiveness of cancer diagnostics, thereby driving market growth. The cancer diagnostics market is expected to benefit from these strategic investments, which aim to reduce cancer mortality rates through improved diagnostic capabilities.

Advancements in Diagnostic Technologies

Technological innovations play a crucial role in shaping the cancer diagnostics market. The introduction of next-generation sequencing (NGS), liquid biopsy, and artificial intelligence (AI) in diagnostic processes has revolutionized the way cancer is detected and monitored. These advancements enable more precise and less invasive testing methods, which are increasingly preferred by both patients and healthcare providers. For instance, liquid biopsy allows for the detection of circulating tumor DNA, providing insights into tumor dynamics without the need for invasive tissue biopsies. The market for these advanced diagnostic technologies is expected to reach approximately $20 billion by 2026, reflecting a growing recognition of their potential to enhance diagnostic accuracy and patient care in the cancer diagnostics market.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is reshaping the landscape of the cancer diagnostics market. As treatments become increasingly tailored to individual patient profiles, the need for precise diagnostic tools that can identify specific biomarkers is paramount. This trend is driven by the recognition that different cancer types and even individual tumors can respond differently to therapies. Consequently, the market for companion diagnostics, which are tests designed to determine the suitability of a particular treatment for a patient, is expanding rapidly. By 2027, the companion diagnostics segment is expected to account for over 30% of the total cancer diagnostics market. This growing demand for personalized approaches underscores the importance of advanced diagnostic technologies in ensuring optimal treatment outcomes for cancer patients.

Increased Focus on Preventive Healthcare

The rising emphasis on preventive healthcare is a significant driver of the cancer diagnostics market. As awareness of the benefits of early detection grows, more individuals are seeking regular screenings and diagnostic tests. This trend is supported by various public health campaigns and initiatives aimed at educating the population about cancer risks and the importance of early intervention. In 2025, it is estimated that nearly 50% of adults in the US will participate in routine cancer screenings, reflecting a cultural shift towards proactive health management. This increased participation is likely to boost demand for diagnostic services and technologies, thereby propelling growth in the cancer diagnostics market. The focus on prevention not only enhances patient outcomes but also reduces the overall burden on healthcare systems.