US Carbon Nanotube Market Summary

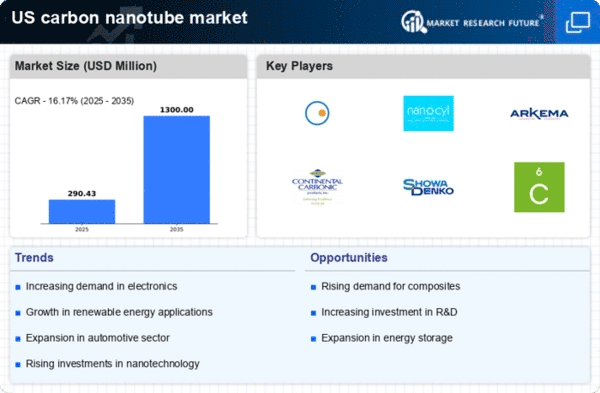

As per Market Research Future analysis, the US carbon nanotube market size was estimated at 250.0 USD Million in 2024. The US carbon nanotube market is projected to grow from 290.43 USD Million in 2025 to 1300.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 16.1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US carbon nanotube market is poised for substantial growth driven by technological advancements and increasing demand across various sectors.

- The electronics segment appears to be the largest, driven by the rising demand for advanced materials in devices.

- Advancements in material science suggest that the fastest-growing segment may be in biomedical applications, reflecting innovative uses of carbon nanotubes.

- A focus on sustainable production indicates a shift towards environmentally friendly manufacturing processes in the industry.

- Increased investment in nanotechnology and growing demand for lightweight materials are likely to be key drivers of market expansion.

Market Size & Forecast

| 2024 Market Size | 250.0 (USD Million) |

| 2035 Market Size | 1300.0 (USD Million) |

| CAGR (2025 - 2035) | 16.17% |

Major Players

Nanosys (US), Nanocyl (BE), Arkema (FR), Continental Carbon (US), Showa Denko (JP), Ocsial (MD), Hyperion Catalysis International (US), SABIC (SA)