Rising Prevalence of Dental Disorders

The increasing incidence of dental disorders in the US is a primary driver for the cbct dental-imaging market. As oral health issues become more prevalent, the demand for advanced imaging solutions rises. According to recent data, nearly 50% of adults in the US experience some form of periodontal disease, necessitating precise diagnostic tools. CBCT imaging provides enhanced visualization of dental structures, allowing for better treatment planning and outcomes. This trend is likely to continue, as the population ages and awareness of dental health increases. Consequently, dental practitioners are increasingly adopting cbct technology to improve diagnostic accuracy and patient care, thereby propelling market growth.

Increased Focus on Preventive Dental Care

The growing emphasis on preventive dental care is shaping the cbct dental-imaging market. As healthcare providers and patients recognize the importance of early detection and intervention, the demand for advanced imaging technologies rises. CBCT imaging allows for comprehensive assessments of dental health, enabling practitioners to identify potential issues before they escalate. This proactive approach is supported by various public health initiatives aimed at improving oral health outcomes. The market is expected to benefit from this trend, as more dental practices integrate cbct imaging into their preventive care protocols, enhancing patient engagement and satisfaction.

Technological Innovations in Imaging Systems

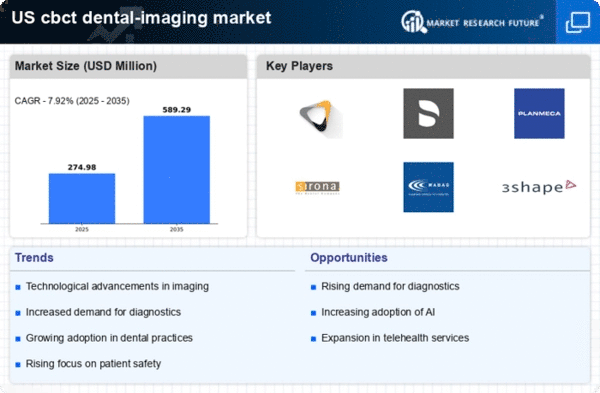

Technological advancements in imaging systems are a significant catalyst for the cbct dental-imaging market. Innovations such as improved image resolution, reduced radiation exposure, and enhanced software capabilities are making cbct systems more appealing to dental practitioners. The introduction of portable cbct units has also expanded access to advanced imaging in various clinical settings. As of 2025, the market for cbct systems is projected to reach approximately $1 billion, reflecting a compound annual growth rate (CAGR) of around 10%. These innovations not only improve diagnostic capabilities but also enhance patient experience, thereby driving market growth.

Growing Adoption of Minimally Invasive Procedures

The shift towards minimally invasive dental procedures is significantly influencing the cbct dental-imaging market. As patients increasingly prefer treatments that reduce recovery time and discomfort, dental professionals are adopting technologies that facilitate such procedures. CBCT imaging plays a crucial role in this transition by providing detailed 3D images that assist in precise planning and execution of minimally invasive techniques. This trend is reflected in the rising number of dental implants and orthodontic treatments, which have seen a growth rate of approximately 15% annually. The ability of cbct imaging to enhance procedural outcomes is likely to further drive its adoption in the dental field.

Regulatory Support for Advanced Imaging Technologies

Regulatory bodies in the US are increasingly supporting the adoption of advanced imaging technologies, which is positively impacting the cbct dental-imaging market. Initiatives aimed at streamlining the approval process for new imaging devices and promoting their use in clinical practice are encouraging dental professionals to invest in cbct systems. This regulatory environment fosters innovation and ensures that practitioners have access to the latest technologies. As a result, the market is likely to experience sustained growth, with an increasing number of dental practices incorporating cbct imaging into their diagnostic and treatment workflows.