Rising Chronic Disease Prevalence

The increasing prevalence of chronic diseases in the US is a pivotal driver for the clinical laboratory-services market. Conditions such as diabetes, cardiovascular diseases, and cancer necessitate regular monitoring and testing, thereby propelling demand for laboratory services. According to the Centers for Disease Control and Prevention (CDC), approximately 6 in 10 adults in the US have a chronic disease, which underscores the need for ongoing laboratory assessments. This trend is likely to continue, as the aging population further exacerbates the burden of chronic illnesses. Consequently, clinical laboratories are expected to expand their service offerings to accommodate the growing need for diagnostic testing, which may lead to increased revenue streams and market growth.

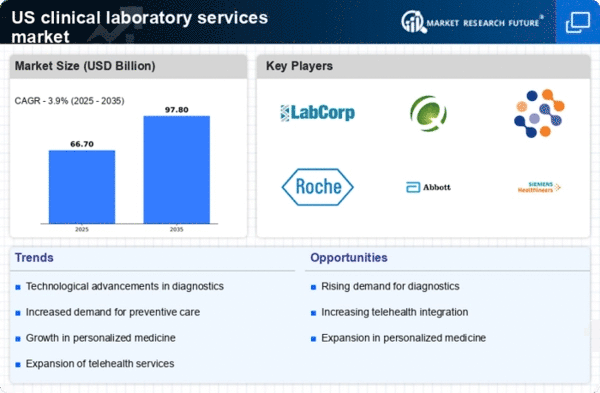

Shift Towards Personalized Medicine

The clinical laboratory-services market is experiencing a notable shift towards personalized medicine, which tailors medical treatment to individual characteristics. This trend is driven by advancements in genomics and biotechnology, enabling more precise diagnostic tests. The National Institutes of Health (NIH) indicates that personalized medicine could potentially reduce healthcare costs by up to 30% through more effective treatments. As healthcare providers increasingly adopt personalized approaches, the demand for specialized laboratory services is likely to rise. This shift not only enhances patient outcomes but also stimulates innovation within the clinical laboratory-services market, as laboratories invest in new technologies and methodologies to meet the evolving needs of healthcare providers.

Growing Focus on Point-of-Care Testing

The clinical laboratory-services market is witnessing a growing focus on point-of-care testing (POCT), which allows for immediate diagnostic results at the site of patient care. This trend is driven by the demand for rapid testing solutions, particularly in emergency and primary care settings. The convenience and efficiency of POCT can significantly enhance patient management, as timely results facilitate quicker clinical decisions. According to the FDA, the market for POCT is projected to grow at a CAGR of 10% through 2027. As healthcare providers increasingly adopt POCT technologies, clinical laboratories are likely to expand their offerings to include these rapid testing solutions, thereby enhancing their competitive positioning.

Increased Investment in Laboratory Infrastructure

Investment in laboratory infrastructure is a crucial driver for the clinical laboratory-services market. As the demand for testing services continues to rise, laboratories are compelled to upgrade their facilities and equipment to enhance efficiency and accuracy. The US government has allocated substantial funding to improve laboratory capabilities, particularly in underserved areas. This investment is expected to bolster the capacity of clinical laboratories to meet the growing demand for diagnostic services. Furthermore, advancements in automation and information technology are likely to streamline laboratory operations, reduce turnaround times, and improve overall service quality. As a result, the clinical laboratory-services market is poised for robust growth in the coming years.

Integration of Laboratory Services with Healthcare Systems

The integration of clinical laboratory services with broader healthcare systems is emerging as a significant driver in the clinical laboratory-services market. This trend facilitates improved patient care through streamlined processes and enhanced data sharing among healthcare providers. The American Hospital Association reports that integrated systems can lead to a 20% reduction in unnecessary tests, thereby optimizing resource utilization. As healthcare organizations increasingly recognize the value of integrated services, clinical laboratories are likely to form strategic partnerships with hospitals and clinics. This collaboration not only enhances operational efficiency but also positions laboratories to better respond to the dynamic needs of the healthcare landscape.