Innovative Product Development

Innovation plays a crucial role in the cocoa fillings market, as manufacturers continuously seek to develop new and exciting products. The introduction of unique flavor combinations and textures is essential for attracting consumers. For instance, the incorporation of exotic ingredients such as spices or fruits into cocoa fillings has gained traction. This trend is indicative of a broader movement within the cocoa fillings market, where creativity and experimentation are prioritized. As a result, companies that invest in research and development are likely to gain a competitive edge, potentially increasing their market share and profitability.

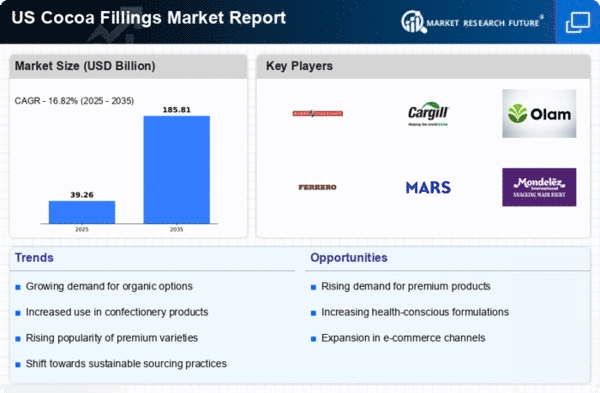

Rising Demand for Premium Products

The cocoa fillings market experiences a notable surge in demand for premium and high-quality products. Consumers increasingly seek indulgent experiences, leading to a preference for gourmet cocoa fillings. This trend is reflected in the market, where premium cocoa fillings account for approximately 30% of total sales. The willingness to pay a premium price for superior taste and quality indicates a shift in consumer behavior. As a result, manufacturers are focusing on enhancing the quality of their cocoa fillings to cater to this growing segment. The cocoa fillings market is thus adapting to these preferences by innovating and introducing new flavors and textures that appeal to discerning consumers.

Expansion of the Confectionery Sector

The cocoa fillings market benefits from the ongoing expansion of the confectionery sector in the US. With the confectionery industry projected to reach $50 billion by 2026, the demand for cocoa fillings is expected to rise correspondingly. This growth is driven by the increasing consumption of chocolates, pastries, and other sweet treats that utilize cocoa fillings as a key ingredient. The cocoa fillings market is poised to capitalize on this trend, as manufacturers develop new products that align with consumer preferences for unique and flavorful fillings. The integration of cocoa fillings into various confectionery items enhances their appeal, thereby driving market growth.

Increased Focus on Clean Label Products

The cocoa fillings market is witnessing a shift towards clean label products, as consumers become more health-conscious and ingredient-savvy. There is a growing demand for cocoa fillings that are free from artificial additives and preservatives. This trend is reflected in the cocoa fillings market, where manufacturers are reformulating their products to meet these expectations. Approximately 40% of consumers express a preference for products with transparent ingredient lists. As a result, companies that prioritize clean label formulations are likely to attract a larger customer base, thereby enhancing their market position.

Growing Popularity of Baking and Home Cooking

The cocoa fillings market is positively influenced by the growing popularity of baking and home cooking among consumers. As more individuals engage in baking as a hobby, the demand for high-quality cocoa fillings has increased. This trend is particularly evident in the rise of homemade desserts and pastries, where cocoa fillings serve as a key ingredient. The cocoa fillings market is responding to this demand by offering a variety of products tailored for home bakers, including ready-to-use fillings and baking kits. This shift not only boosts sales but also fosters a deeper connection between consumers and the products they use.