Health-Conscious Consumer Trends

In recent years, there has been a marked shift towards health-conscious consumer behavior, significantly impacting the confectionery flexible-packaging market. As individuals become more aware of their dietary choices, there is a growing demand for healthier confectionery options, including low-sugar and organic products. This trend necessitates packaging that clearly communicates nutritional information and ingredient transparency. Data suggests that the market for healthier snacks is expected to grow by 6% annually, prompting confectionery manufacturers to rethink their packaging strategies. Flexible packaging allows for clear labeling and attractive designs that can highlight health benefits, thus appealing to this demographic. Consequently, This trend ensures that packaging protects the product while aligning with consumer values..

Rising Demand for Convenience Foods

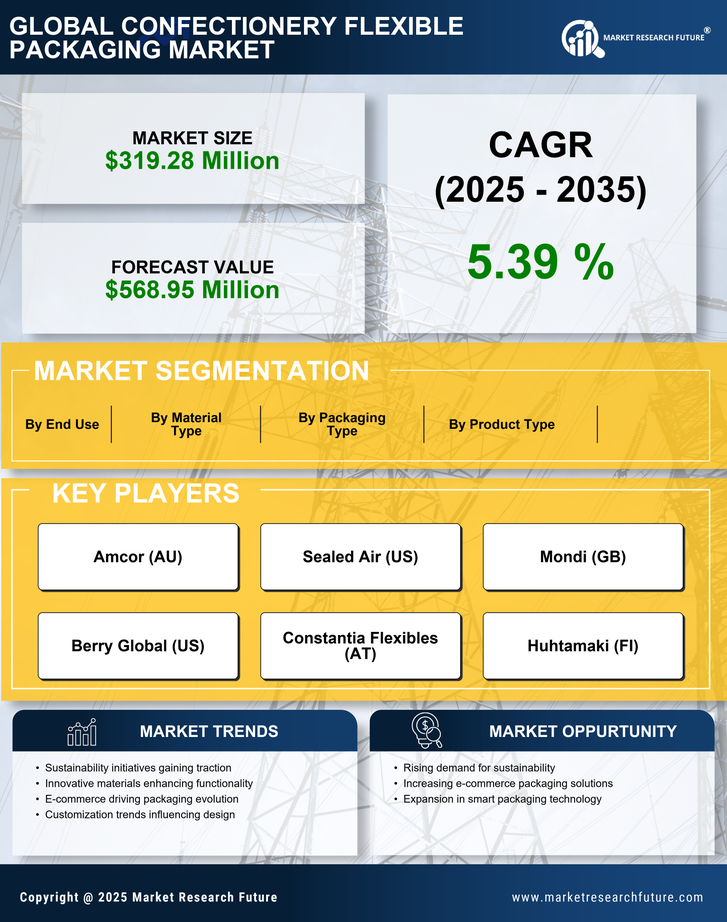

The confectionery flexible-packaging market is experiencing a notable surge in demand for convenience foods. As consumers increasingly seek on-the-go options, manufacturers are adapting their packaging solutions to meet these preferences. Flexible packaging offers lightweight, portable, and resealable features that align with the fast-paced lifestyles of modern consumers. According to recent data, the convenience food sector is projected to grow at a CAGR of approximately 4.5% through 2026, which directly influences the packaging choices made by confectionery producers. This trend indicates a shift towards packaging that not only preserves product freshness but also enhances user experience. As a result, the confectionery flexible-packaging market is likely to expand, driven by the need for innovative solutions that cater to the evolving demands of consumers.

E-commerce Growth and Online Retailing

The rapid growth of e-commerce and online retailing is significantly influencing the confectionery flexible-packaging market. As more consumers turn to online shopping for their confectionery needs, the demand for packaging that ensures product integrity during shipping has intensified. Flexible packaging is particularly advantageous in this context, as it can be designed to withstand the rigors of transportation while maintaining product freshness. Data indicates that e-commerce sales in the food sector are projected to grow by 20% annually, which presents a substantial opportunity for confectionery brands. This shift necessitates innovative packaging solutions that not only protect products but also enhance the unboxing experience for consumers. Consequently, The confectionery flexible-packaging market is evolving to meet e-commerce trends, with a focus on durability and aesthetic appeal..

Technological Advancements in Packaging

Technological advancements are playing a crucial role in shaping the confectionery flexible-packaging market. Innovations in materials and production processes are enabling manufacturers to create packaging that is not only more efficient but also more sustainable. For instance, the introduction of biodegradable and recyclable materials is becoming increasingly prevalent, as companies strive to reduce their environmental footprint. Recent statistics indicate that the market for sustainable packaging is expected to reach $500 billion by 2027, highlighting the urgency for confectionery producers to adopt these technologies. Moreover, advancements in printing technology allow for high-quality graphics and designs that enhance brand visibility. As a result, the confectionery flexible-packaging market is likely to benefit from these technological improvements, which can lead to increased consumer engagement and brand loyalty.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly shaping the confectionery flexible-packaging market. As food safety regulations become more stringent, manufacturers are compelled to ensure that their packaging meets these requirements. This includes using materials that are safe for food contact and can withstand various environmental conditions. Recent regulations have emphasized the importance of traceability and transparency in packaging, which has led to a greater focus on quality control processes. The confectionery flexible-packaging market must adapt to these evolving standards, which may involve investing in new technologies and materials. As a result, companies that prioritize compliance are likely to gain a competitive edge, ensuring that their products are not only appealing but also safe for consumers.