US Cosmetic Antioxidants Market Summary

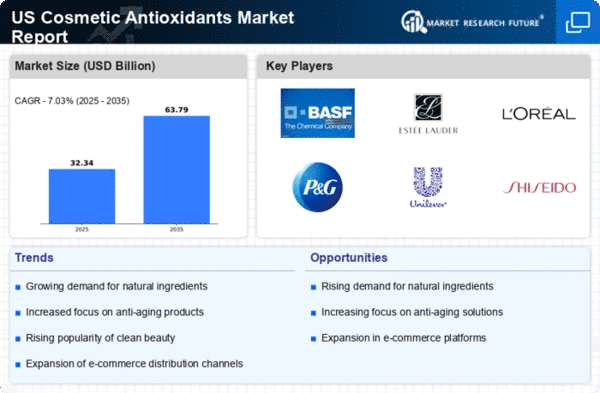

As per analysis, the US cosmetic antioxidants market size was estimated at 30.22 USD Billion in 2024. The US cosmetic antioxidants market is projected to grow from 32.34 USD Billion in 2025 to 63.79 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US cosmetic antioxidants market is experiencing a notable shift towards natural ingredients and anti-aging solutions.

- The market is witnessing a rise in the use of natural ingredients, reflecting a broader consumer preference for clean beauty products.

- Technological advancements in formulation are enhancing the efficacy and appeal of antioxidant products in the cosmetic sector.

- The anti-aging segment remains the largest, driven by increasing consumer awareness of skin health and the influence of social media.

- Growing demand for anti-aging products and regulatory support for natural ingredients are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 30.22 (USD Billion) |

| 2035 Market Size | 63.79 (USD Billion) |

| CAGR (2025 - 2035) | 7.03% |

Major Players

BASF SE (DE), The Estée Lauder Companies Inc. (US), L'Oréal S.A. (FR), Procter & Gamble Co. (US), Unilever PLC (GB), Shiseido Company Limited (JP), Coty Inc. (US), Amway Corporation (US), Beiersdorf AG (DE)