Seasonal Variations in Illness Patterns

Seasonal variations in illness patterns, particularly during colder months, appear to play a crucial role in the cough syrup market. The incidence of colds and flu typically rises during winter, leading to increased consumption of cough syrups. Data from health organizations indicates that flu cases can spike by as much as 30% during peak seasons, driving demand for cough relief products. This seasonal trend suggests that manufacturers may need to prepare for fluctuations in production and inventory to meet the anticipated surge in demand. Consequently, the cough syrup market is likely to see significant sales increases during these peak periods, highlighting the importance of seasonal factors in market dynamics.

Expansion of Retail Distribution Channels

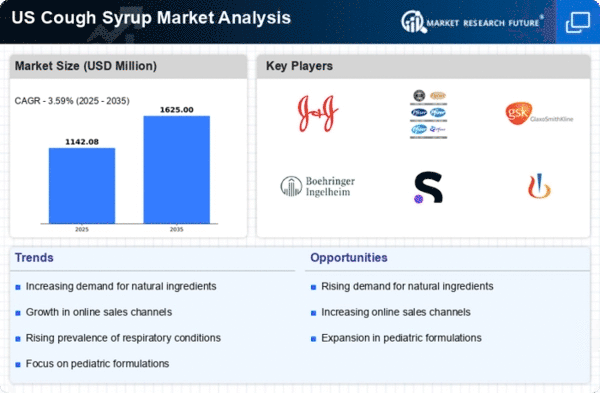

The expansion of retail distribution channels is significantly impacting the cough syrup market. With the rise of pharmacies, supermarkets, and online platforms, consumers have greater access to a variety of cough syrup options. This increased availability is likely to enhance consumer convenience and drive sales. Recent data indicates that online sales of cough syrups have surged by 20% in the last year, reflecting a shift in shopping habits. Retailers are also investing in marketing strategies to promote cough syrups, further stimulating demand. As more consumers turn to these accessible channels for their healthcare needs, the cough syrup market is expected to experience robust growth.

Rising Incidence of Respiratory Disorders

The increasing prevalence of respiratory disorders in the US appears to be a primary driver for the cough syrup market. Conditions such as asthma, bronchitis, and seasonal allergies contribute to a heightened demand for effective cough relief solutions. According to recent health statistics, approximately 25 million Americans suffer from asthma, which often necessitates the use of cough syrups as part of their treatment regimen. This trend indicates a growing market potential, as consumers seek over-the-counter remedies to alleviate symptoms. Furthermore, the aging population, which is more susceptible to respiratory issues, is likely to further bolster the cough syrup market. As healthcare providers increasingly recommend cough syrups for symptomatic relief, the market is poised for expansion.

Technological Advancements in Product Development

Technological advancements in product development are reshaping the cough syrup market. Innovations in formulation and delivery methods are enabling manufacturers to create more effective and user-friendly products. For instance, the introduction of liquid gels and dissolvable strips has expanded the options available to consumers. Additionally, advancements in research and development are leading to the creation of targeted formulations that address specific symptoms more effectively. Market analysis indicates that products utilizing these new technologies are gaining traction, with sales growth of approximately 10% in the last year. As companies continue to invest in research and development, the cough syrup market is likely to benefit from enhanced product offerings and increased consumer interest.

Increased Consumer Awareness of Health and Wellness

Consumer awareness regarding health and wellness is on the rise, influencing purchasing decisions in the cough syrup market. Individuals are becoming more informed about the ingredients in their medications, leading to a preference for products that are perceived as safe and effective. This trend is reflected in the growing demand for cough syrups that contain natural or organic ingredients, as consumers seek alternatives to traditional formulations. Market data suggests that products marketed as 'natural' have seen a sales increase of approximately 15% over the past year. This shift in consumer behavior is prompting manufacturers to innovate and reformulate their products to align with health-conscious preferences, thereby driving growth in the cough syrup market.