Aging Population

The demographic shift towards an aging population in the US is a crucial factor influencing the critical illness-insurance market. By 2030, it is estimated that around 20% of the US population will be aged 65 and older. This demographic is more susceptible to chronic illnesses, which increases the demand for insurance products that provide coverage for critical health conditions. The critical illness-insurance market is likely to see a surge in demand as older adults seek financial security and peace of mind. Insurers may respond by developing tailored products that cater specifically to the needs of this demographic, further driving market growth.

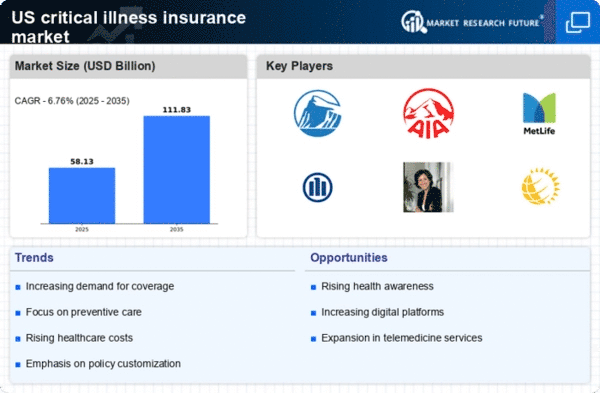

Rising Healthcare Costs

The escalating costs associated with healthcare in the US are a primary driver for the critical illness-insurance market. As medical expenses continue to rise, individuals are increasingly seeking financial protection against unforeseen health issues. In 2025, healthcare spending is projected to reach approximately $4.3 trillion, which represents a significant burden on personal finances. This trend compels consumers to consider critical illness insurance as a viable option to mitigate potential financial strain. The critical illness-insurance market is thus positioned to benefit from this growing concern, as more individuals recognize the importance of safeguarding their financial future against high medical costs.

Employer-Sponsored Insurance Initiatives

Employer-sponsored insurance initiatives are playing a pivotal role in the growth of the critical illness-insurance market. Many employers are increasingly offering critical illness insurance as part of their employee benefits packages. This trend is driven by the desire to enhance employee well-being and reduce absenteeism due to health issues. In 2025, it is estimated that over 60% of employers will provide some form of critical illness coverage to their employees. The critical illness-insurance market is thus likely to experience growth as more companies recognize the value of offering such benefits, leading to increased enrollment and awareness among employees.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is significantly impacting the critical illness-insurance market. As more individuals adopt healthier lifestyles and preventive measures, there is a corresponding increase in awareness about the importance of financial protection against critical illnesses. This shift in mindset encourages consumers to consider insurance products that provide coverage for serious health conditions. In 2025, it is anticipated that spending on preventive services will account for a larger share of overall healthcare expenditures. The critical illness-insurance market is likely to benefit from this trend, as insurers may develop products that reward healthy behaviors, thus attracting a broader customer base.

Technological Advancements in Health Monitoring

Technological innovations in health monitoring and diagnostics are reshaping the landscape of the critical illness-insurance market. Wearable devices and telemedicine are becoming increasingly prevalent, allowing for early detection and management of health issues. This trend not only enhances patient outcomes but also influences insurance providers to adjust their offerings. Insurers may leverage data from these technologies to create more personalized policies, potentially leading to lower premiums for healthier individuals. The critical illness-insurance market stands to gain from these advancements, as they may encourage more consumers to invest in insurance products that align with their health management strategies.