Growing Focus on Health Equity

The digital healthcare market is increasingly addressing health equity, which is becoming a prominent driver of growth. There is a growing recognition of the disparities in healthcare access and outcomes among different populations in the US. Digital health solutions have the potential to bridge these gaps by providing accessible care to underserved communities. Initiatives aimed at increasing digital literacy and access to technology are being implemented to ensure that all individuals can benefit from digital healthcare innovations. As stakeholders prioritize health equity, the digital healthcare market is likely to expand, driven by the demand for inclusive and equitable healthcare solutions.

Increased Investment in Health IT

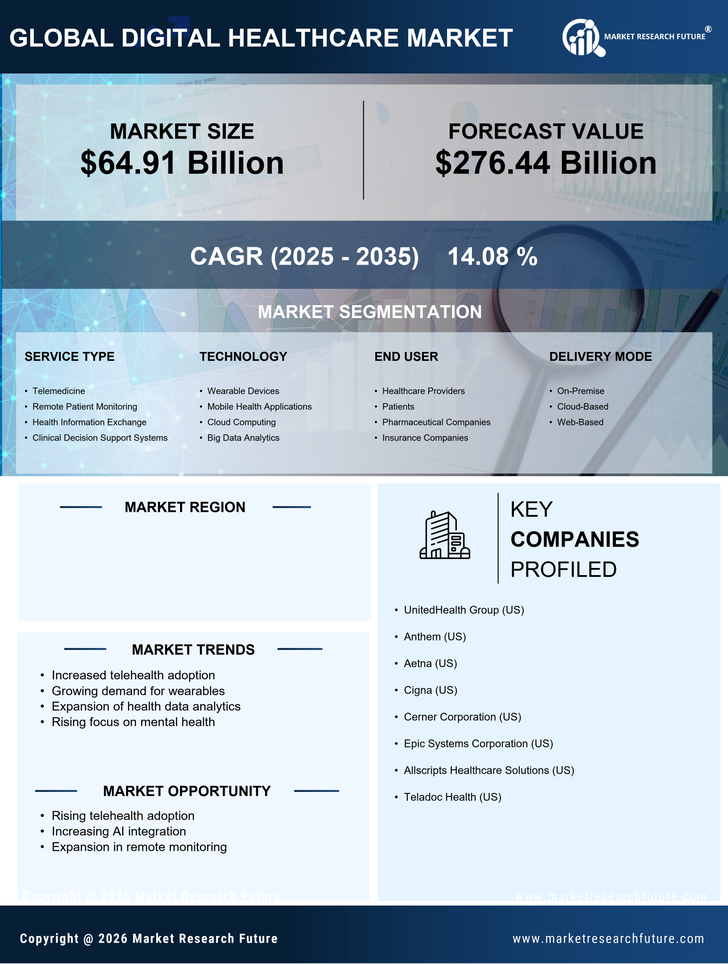

Investment in health information technology (IT) is a critical driver of the digital healthcare market. In recent years, funding for health IT solutions has escalated, with estimates suggesting that the market could reach $250 billion by 2025. This influx of capital is primarily directed towards developing innovative digital solutions that enhance patient care and streamline healthcare operations. As healthcare organizations seek to improve efficiency and reduce costs, the adoption of electronic health records (EHRs), telemedicine platforms, and data analytics tools is becoming more prevalent. Consequently, the digital healthcare market is likely to benefit from this trend, as organizations increasingly recognize the value of investing in advanced health IT systems.

Rising Demand for Remote Monitoring

The digital healthcare market is experiencing a notable surge in demand for remote monitoring solutions. This trend is driven by an increasing prevalence of chronic diseases, which necessitates continuous patient monitoring. According to recent data, approximately 60% of adults in the US manage at least one chronic condition, leading to a heightened need for effective remote monitoring tools. These tools enable healthcare providers to track patient health metrics in real-time, thereby improving patient outcomes and reducing hospital readmissions. The convenience and accessibility offered by remote monitoring solutions are likely to enhance patient engagement and adherence to treatment plans, further propelling the growth of the digital healthcare market.

Consumer Preference for Digital Health Solutions

Consumer preferences are shifting towards digital health solutions, significantly impacting the digital healthcare market. A recent survey indicates that over 70% of patients in the US prefer using digital tools for managing their health, including mobile health applications and telehealth services. This growing inclination towards digital solutions is driven by the convenience, accessibility, and personalized care that these technologies offer. As patients become more tech-savvy, their expectations for healthcare services evolve, prompting providers to adopt digital solutions to meet these demands. This shift in consumer behavior is likely to catalyze further innovation and expansion within the digital healthcare market.

Regulatory Support for Digital Health Innovations

Regulatory support is emerging as a vital driver for the digital healthcare market. The US government has implemented various initiatives aimed at promoting the adoption of digital health technologies. For instance, the Centers for Medicare & Medicaid Services (CMS) has expanded reimbursement policies for telehealth services, encouraging healthcare providers to integrate these solutions into their practices. This regulatory backing not only fosters innovation but also enhances the financial viability of digital health solutions. As regulations continue to evolve in favor of digital health, the market is expected to witness accelerated growth, as stakeholders leverage these supportive frameworks to enhance patient care.