Regulatory Support and Compliance

Regulatory frameworks are evolving to support the growth of the digital payment market, providing a conducive environment for innovation. In the US, recent legislation has aimed at enhancing consumer protection and promoting secure payment methods. For instance, the implementation of the Payment Services Directive has encouraged transparency and competition among payment service providers. This regulatory support is expected to foster trust among consumers, which is essential for the digital payment market's expansion. As compliance becomes more streamlined, businesses are likely to invest more in digital payment solutions, further propelling market growth.

Growing Focus on Financial Inclusion

Financial inclusion is becoming a key focus area in the digital payment market, as efforts to provide access to financial services for underserved populations gain momentum. Initiatives aimed at integrating digital payment solutions into low-income communities are expected to drive market growth. In 2025, it is estimated that approximately 30% of unbanked individuals in the US will gain access to digital payment platforms, facilitating their participation in the economy. This focus on inclusion not only expands the customer base for digital payment providers but also enhances overall economic activity. As more individuals gain access to these services, the digital payment market is likely to experience substantial growth.

Rise of E-commerce and Online Shopping

The surge in e-commerce and online shopping is a pivotal driver of the digital payment market. In 2025, online retail sales in the US are projected to reach $1 trillion, with a significant portion of these transactions being processed through digital payment methods. This trend is encouraging retailers to adopt digital payment solutions to meet consumer expectations for fast and secure transactions. The convenience of online shopping, coupled with the increasing use of mobile devices, is likely to further accelerate the growth of the digital payment market. As more consumers turn to online platforms, the demand for efficient payment solutions will continue to rise.

Increasing Consumer Demand for Convenience

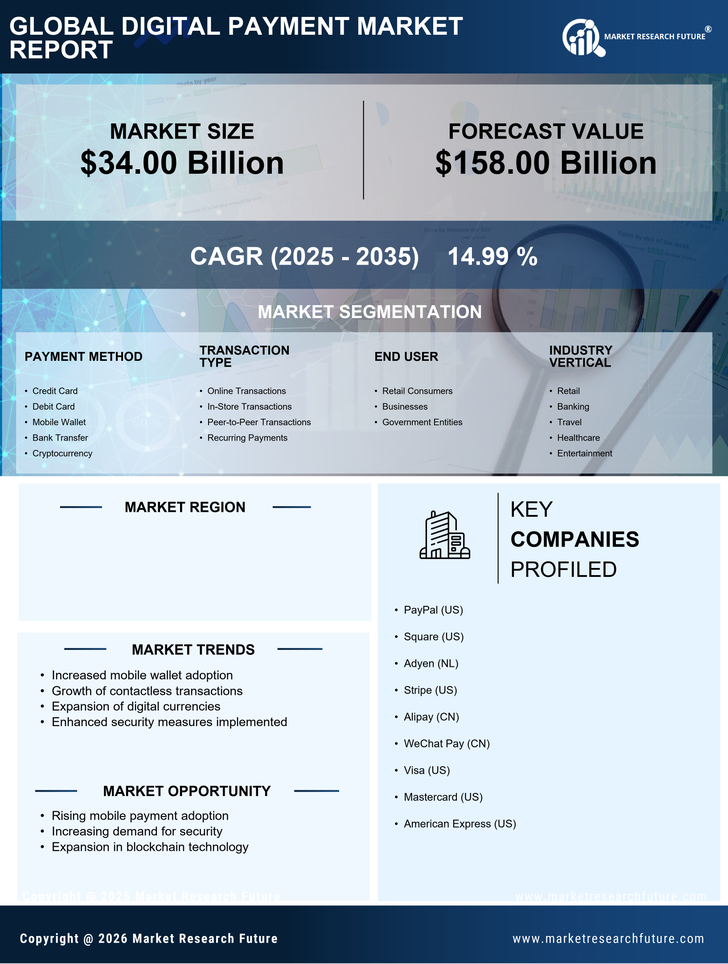

Consumer preferences are shifting towards more convenient payment methods, significantly impacting the digital payment market. A recent survey indicates that over 70% of consumers prefer using digital wallets for their transactions due to the ease of use and speed. This demand for convenience is prompting businesses to adopt digital payment solutions that cater to customer preferences. As a result, the digital payment market is projected to grow at a CAGR of 15% over the next five years. The emphasis on seamless transactions is likely to encourage more retailers to integrate digital payment options, thereby expanding the market's reach and accessibility.

Technological Advancements in Payment Systems

The digital payment market is experiencing rapid technological advancements that are reshaping the landscape of financial transactions. Innovations such as blockchain technology and artificial intelligence are enhancing transaction speed and security. In 2025, it is estimated that the adoption of blockchain in payment systems could increase transaction efficiency by up to 30%. Furthermore, the integration of AI in fraud detection is expected to reduce fraudulent transactions by approximately 25%. These advancements not only streamline processes but also build consumer trust, which is crucial for the growth of the digital payment market. As technology continues to evolve, it is likely that new solutions will emerge, further driving the digital payment market forward.