Increasing Focus on Patient Safety

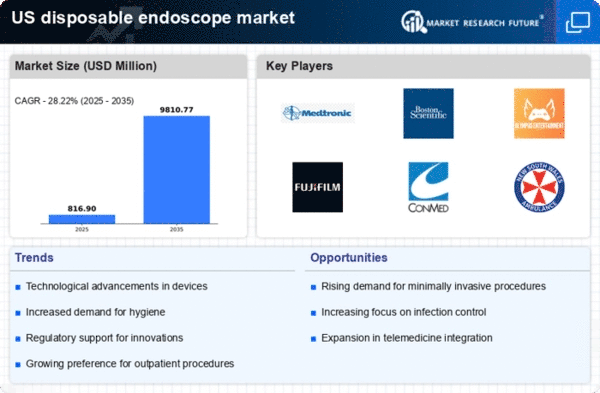

The disposable endoscope market is experiencing growth due to an increasing focus on patient safety. Healthcare providers are prioritizing the reduction of hospital-acquired infections, which has led to a shift towards single-use endoscopes. These devices minimize the risk of cross-contamination, thereby enhancing patient outcomes. According to recent data, the market for disposable endoscopes is projected to grow at a CAGR of approximately 12% over the next few years. This trend is particularly evident in surgical settings where infection control is paramount. As hospitals and clinics adopt stringent safety protocols, the disposable endoscope market is likely to expand, driven by the need for safer medical procedures.

Regulatory Support for Single-Use Devices

Regulatory bodies in the US are increasingly supporting the use of single-use medical devices, including those in the disposable endoscope market. This support is evident in the streamlined approval processes for new disposable technologies, which encourages innovation and market entry. As regulations evolve to favor disposable solutions, manufacturers are likely to invest more in research and development. This regulatory environment not only enhances the safety profile of disposable endoscopes but also fosters competition among manufacturers, potentially leading to improved product offerings and lower prices for healthcare providers.

Cost-Effectiveness of Disposable Solutions

The disposable endoscope market is also driven by the cost-effectiveness associated with single-use devices. While the initial purchase price of disposable endoscopes may appear higher than reusable ones, the overall cost savings become apparent when considering the expenses related to sterilization, maintenance, and potential infection-related complications. Healthcare facilities are increasingly recognizing that disposable endoscopes can reduce long-term costs, which is crucial in a landscape where budget constraints are prevalent. The market is expected to witness a surge in adoption as financial decision-makers in healthcare weigh the benefits of disposable solutions against traditional methods.

Technological Innovations Enhancing Usability

Technological innovations are playing a crucial role in the disposable endoscope market, enhancing usability and performance. Advances in materials and design have led to the development of more flexible and user-friendly endoscopes, which can improve the overall experience for both healthcare providers and patients. Features such as improved imaging capabilities and ergonomic designs are becoming standard, making these devices more appealing. As technology continues to evolve, the disposable endoscope market is likely to benefit from increased adoption rates, as healthcare professionals seek tools that enhance diagnostic accuracy and patient comfort.

Rising Incidence of Gastrointestinal Disorders

The disposable endoscope market is witnessing growth due to the rising incidence of gastrointestinal disorders in the US. Conditions such as colorectal cancer and inflammatory bowel disease are becoming more prevalent, necessitating increased diagnostic procedures. As healthcare providers seek efficient and safe methods for diagnosis, the demand for disposable endoscopes is likely to rise. Recent statistics indicate that gastrointestinal disorders account for a significant portion of healthcare expenditures, further driving the need for effective diagnostic tools. This trend suggests a robust future for the disposable endoscope market as it aligns with the growing healthcare needs of the population.