Rising Adoption of Smart Devices

The rising adoption of smart devices is a pivotal factor influencing the edge analytics market. As more devices become interconnected through the Internet of Things (IoT), the volume of data generated at the edge continues to grow exponentially. This proliferation of smart devices necessitates advanced analytics solutions that can process and analyze data locally, thereby reducing the burden on centralized systems. In November 2025, it is estimated that the number of connected devices in the US has surpassed 30 billion, creating a substantial opportunity for the edge analytics market. This trend underscores the importance of developing robust analytics frameworks capable of handling diverse data streams from various sources.

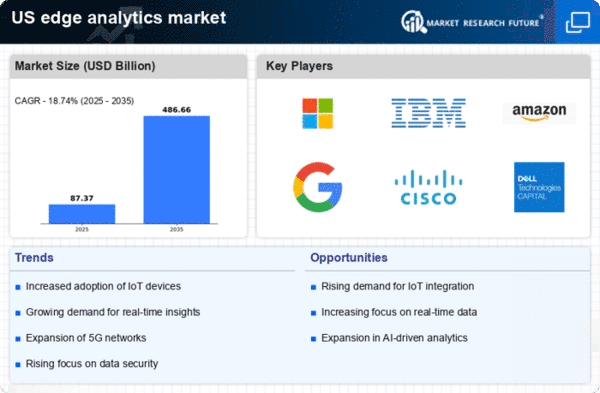

Expansion of 5G Network Infrastructure

The expansion of 5G network infrastructure is significantly influencing the edge analytics market. With the rollout of 5G technology, organizations can expect enhanced connectivity and reduced latency, which are crucial for effective edge analytics applications. This advancement allows for the seamless transmission of large volumes of data from edge devices to analytics platforms, facilitating quicker decision-making processes. As of November 2025, it is estimated that 5G adoption in the US has reached approximately 50%, further propelling the edge analytics market. The ability to process data closer to its source not only improves response times but also optimizes bandwidth usage, making it a vital driver for the industry.

Increased Focus on Operational Efficiency

A growing emphasis on operational efficiency is driving the edge analytics market forward. Businesses are increasingly seeking ways to streamline processes and reduce costs, and edge analytics provides the tools necessary to achieve these goals. By analyzing data at the source, organizations can identify inefficiencies and implement corrective measures in real-time. This trend is particularly evident in sectors such as logistics and supply chain management, where timely insights can lead to significant cost savings. The edge analytics market is expected to benefit from this focus, with projections indicating a market value of around $12 billion by 2027, highlighting its role in enhancing productivity and efficiency.

Regulatory Compliance and Data Governance

Regulatory compliance and data governance are increasingly shaping the edge analytics market landscape. Organizations are under pressure to adhere to stringent regulations regarding data privacy and security, which necessitates the implementation of effective analytics solutions. Edge analytics can play a crucial role in ensuring compliance by enabling organizations to process sensitive data locally, thereby minimizing exposure to potential breaches. As of November 2025, it is projected that compliance-related expenditures in the US will reach approximately $5 billion, further emphasizing the need for robust edge analytics capabilities. This driver highlights the intersection of technology and regulatory requirements, positioning edge analytics as a vital component in the compliance strategy of many organizations.

Growing Demand for Real-Time Data Processing

the edge analytics market is experiencing a notable increase in real-time data processing capabilities. Organizations across various sectors, including manufacturing and healthcare, are increasingly relying on instantaneous insights to enhance operational efficiency. This trend is driven by the need to make informed decisions quickly, as delays in data processing can lead to missed opportunities. According to recent estimates, the edge analytics market is projected to reach approximately $10 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 25%. This growth is indicative of the market's potential to transform how businesses leverage data at the edge, thereby fostering innovation and competitive advantage.