Advancements in Therapeutic Options

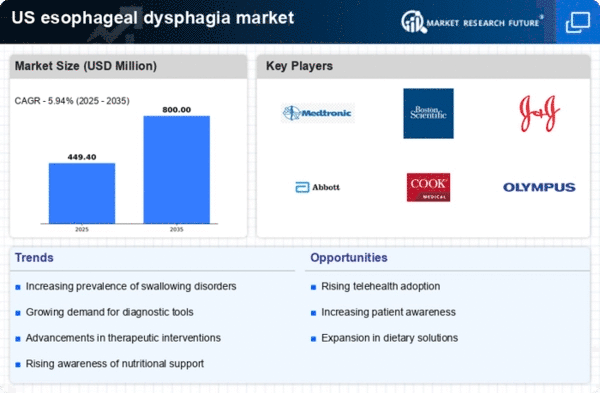

Innovations in therapeutic options for esophageal dysphagia are significantly influencing the market landscape. The development of minimally invasive procedures, such as endoscopic interventions and new drug therapies, enhances treatment efficacy and patient outcomes. For instance, the introduction of novel swallowing aids and devices has shown promise in improving the quality of life for patients suffering from dysphagia. The esophageal dysphagia market is projected to witness a compound annual growth rate (CAGR) of around 6% over the next few years, driven by these advancements. Additionally, the integration of telehealth services is likely to expand access to care, allowing for timely interventions and monitoring, which could further stimulate market growth.

Rising Incidence of Esophageal Disorders

The increasing prevalence of esophageal disorders, including esophageal dysphagia, is a primary driver of the esophageal dysphagia market. As the population ages, the incidence of conditions such as gastroesophageal reflux disease (GERD) and esophageal cancer rises, leading to a higher demand for diagnostic and therapeutic solutions. According to recent estimates, approximately 15-20% of adults in the US experience GERD, which can contribute to dysphagia. This growing patient population necessitates advancements in treatment options and healthcare services, thereby propelling the esophageal dysphagia market forward. Furthermore, the aging demographic is expected to reach 73 million by 2030, indicating a substantial market opportunity for innovative therapies and interventions tailored to this condition.

Regulatory Support for Innovative Treatments

Regulatory bodies in the US are increasingly supportive of innovative treatments for esophageal dysphagia, which is fostering market growth. The expedited approval processes for new therapies and devices are encouraging companies to invest in research and development. Initiatives aimed at streamlining the regulatory pathway for novel interventions are likely to enhance the availability of effective treatment options for patients. This supportive regulatory environment is expected to attract investments in the esophageal dysphagia market, as companies seek to bring their innovations to market more efficiently. As a result, the landscape for treatment options is anticipated to expand, providing patients with a broader range of choices and improving overall care.

Growing Demand for Nutritional Support Solutions

The rising awareness of the nutritional needs of patients with esophageal dysphagia is driving demand for specialized nutritional support solutions. Patients often face challenges in maintaining adequate nutrition due to swallowing difficulties, leading to a need for products such as thickened liquids and pureed foods. The esophageal dysphagia market is responding to this demand by introducing a variety of nutritional supplements and meal replacement options tailored for these patients. Market Research Future indicates that the nutritional support segment is expected to grow at a CAGR of approximately 5% in the coming years, as healthcare providers increasingly recognize the importance of nutrition in managing dysphagia. This trend highlights the necessity for innovative solutions that cater to the unique dietary requirements of affected individuals.

Increased Investment in Healthcare Infrastructure

The ongoing investment in healthcare infrastructure in the US is a crucial driver for the esophageal dysphagia market. Enhanced healthcare facilities and the expansion of specialized centers for gastrointestinal disorders are expected to improve patient access to diagnostic and treatment services. The US government has allocated substantial funding towards healthcare improvements, which includes the establishment of advanced diagnostic centers equipped with state-of-the-art technology. This investment is anticipated to facilitate early detection and management of esophageal dysphagia, ultimately leading to better patient outcomes. As healthcare systems evolve, the demand for specialized services in the esophageal dysphagia market is likely to increase, reflecting a shift towards more comprehensive care.

Leave a Comment