Expansion of Construction Activities

The fiberglass flooring market is poised to benefit from the ongoing expansion of construction activities across the United States. With a robust construction sector, particularly in residential and commercial buildings, the demand for innovative flooring solutions is on the rise. Recent statistics suggest that the construction industry has seen a growth rate of around 5% annually, which directly influences the fiberglass flooring market. Builders and contractors are increasingly opting for fiberglass flooring due to its lightweight nature and ease of installation, which can reduce labor costs. Furthermore, the versatility of fiberglass flooring makes it suitable for various applications, from homes to large commercial spaces, thereby enhancing its market presence.

Growing Awareness of Environmental Impact

the fiberglass flooring market is increasingly shaped by the growing awareness of environmental impact among consumers and businesses. As sustainability becomes a priority, there is a rising demand for flooring solutions that are eco-friendly and contribute to energy efficiency. Fiberglass flooring is often produced using recyclable materials and is known for its energy-efficient properties. Recent surveys indicate that over 60% of consumers are willing to pay a premium for sustainable flooring options. This shift in consumer behavior is prompting manufacturers to adopt greener practices, thereby enhancing the appeal of fiberglass flooring in the market. As environmental considerations continue to shape purchasing decisions, the fiberglass flooring market is likely to see sustained growth.

Technological Innovations in Manufacturing

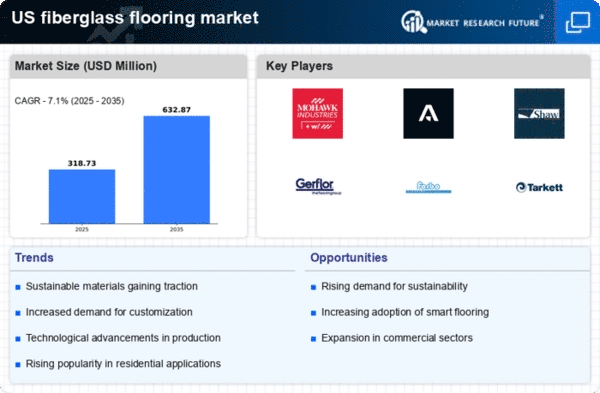

The fiberglass flooring market is witnessing a wave of technological innovations that enhance product quality and performance. Advances in manufacturing processes, such as improved resin formulations and enhanced reinforcement techniques, are leading to the production of more resilient and versatile flooring options. These innovations are crucial as they allow manufacturers to cater to a broader range of applications, from residential to industrial settings. The market is projected to see a growth of approximately 7% in the next few years, driven by these technological advancements. As companies invest in research and development, the fiberglass flooring market is likely to experience an influx of new products that meet the diverse needs of consumers.

Rising Demand for Durable Flooring Solutions

The fiberglass flooring market is experiencing a notable increase in demand for durable flooring solutions. This trend is largely driven by the need for materials that can withstand heavy foot traffic and resist wear and tear. In various sectors, including commercial and industrial applications, fiberglass flooring is recognized for its longevity and low maintenance requirements. The market data indicates that the fiberglass flooring segment is projected to grow at a CAGR of approximately 6% over the next five years. This growth is attributed to the increasing preference for materials that offer both aesthetic appeal and functional durability. As consumers and businesses alike prioritize long-lasting flooring options, the fiberglass flooring market is likely to benefit significantly from this shift in demand.

Increased Focus on Health and Safety Standards

the fiberglass flooring market is greatly influenced by the heightened focus on health and safety standards in various industries. As regulations become more stringent, particularly in sectors such as healthcare and food processing, the demand for flooring materials that meet these standards is increasing. Fiberglass flooring is often favored for its non-porous surface, which helps in maintaining hygiene and preventing the growth of bacteria. Market analysis indicates that the healthcare sector alone is expected to invest over $10 billion in flooring solutions that comply with health regulations. This trend not only boosts the fiberglass flooring market but also encourages manufacturers to innovate and improve their product offerings to meet evolving safety requirements.