Impact of Telehealth Services

The impact of telehealth services on the fibromyalgia treatments market cannot be overlooked. The rise of telemedicine has made it easier for patients to access healthcare providers, particularly for those living in rural or underserved areas. This accessibility is crucial for individuals with fibromyalgia, who may struggle with mobility and transportation. Telehealth services allow for remote consultations, follow-ups, and even therapy sessions, thereby improving patient engagement and adherence to treatment plans. As telehealth continues to evolve, it is likely to play a pivotal role in the fibromyalgia treatments market, facilitating timely interventions and personalized care for patients.

Increased Awareness and Education

Increased awareness and education about fibromyalgia among healthcare professionals and the general public are driving the fibromyalgia treatments market. Initiatives aimed at educating both patients and providers about the symptoms and management of fibromyalgia have led to more accurate diagnoses and treatment plans. This heightened awareness is crucial, as many individuals remain undiagnosed or misdiagnosed, which can delay effective treatment. As educational programs proliferate, the fibromyalgia treatments market is expected to benefit from a surge in demand for therapies, as more patients seek help for their symptoms. This trend may lead to a more informed patient population, ultimately improving treatment outcomes.

Rising Prevalence of Fibromyalgia

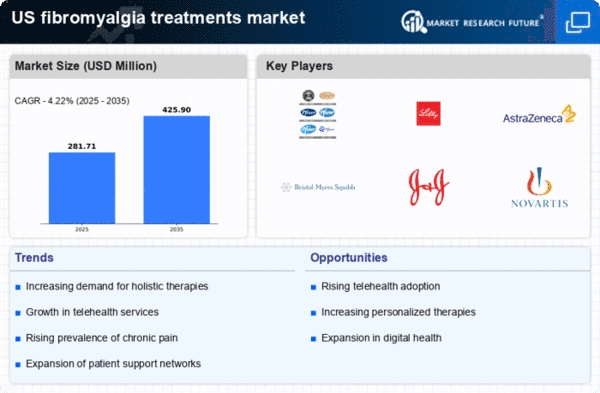

The increasing prevalence of fibromyalgia in the US is a critical driver for the fibromyalgia treatments market. Recent estimates suggest that approximately 4 million adults in the US experience fibromyalgia, which translates to about 2% of the adult population. This growing number of patients necessitates the development and availability of effective treatment options. As awareness of fibromyalgia expands, healthcare providers are more likely to diagnose and treat this condition, thereby driving demand for various therapies. The fibromyalgia treatments market is expected to see a compound annual growth rate (CAGR) of around 5% over the next few years, reflecting the urgent need for innovative solutions to manage this chronic pain disorder.

Advancements in Pharmaceutical Research

Ongoing advancements in pharmaceutical research are significantly influencing the fibromyalgia treatments market. The development of new medications, including novel analgesics and antidepressants, is providing patients with more effective options for managing their symptoms. For instance, drugs like pregabalin and duloxetine have gained traction in recent years, contributing to a market that was valued at approximately $1.5 billion in 2023. Furthermore, research into the underlying mechanisms of fibromyalgia is paving the way for targeted therapies, which may enhance treatment efficacy. As pharmaceutical companies invest in research and development, the fibromyalgia treatments market is likely to expand, offering patients improved therapeutic alternatives.

Growing Demand for Alternative Therapies

The growing demand for alternative therapies is reshaping the fibromyalgia treatments market. Many patients are seeking complementary and alternative medicine (CAM) options, such as acupuncture, yoga, and dietary supplements, to alleviate their symptoms. This trend reflects a broader shift towards holistic approaches in healthcare, where patients are increasingly interested in managing their conditions through non-pharmaceutical means. The fibromyalgia treatments market is likely to adapt to this demand by incorporating a wider range of treatment modalities, potentially enhancing patient satisfaction and adherence to treatment plans. As more research supports the efficacy of these alternative therapies, their integration into standard care practices may become more prevalent.