Expansion of Distribution Channels

The flavored water market is benefiting from the expansion of distribution channels, which enhances product availability and accessibility for consumers. Retailers are increasingly recognizing the potential of flavored water as a profitable category, leading to its presence in a wider array of outlets, including convenience stores, supermarkets, and online platforms. Recent data indicates that e-commerce sales of flavored water have grown by over 20% in the last year, reflecting a shift in consumer purchasing behavior. This diversification of distribution channels is crucial for the flavored water market, as it allows brands to reach a broader audience and cater to varying consumer preferences. As a result, companies are investing in strategic partnerships and innovative marketing strategies to capitalize on this trend.

Emphasis on Sustainability Practices

The flavored water market is increasingly emphasizing sustainability practices, driven by consumer demand for environmentally friendly products. As awareness of environmental issues grows, consumers are more inclined to support brands that prioritize sustainable sourcing and packaging. Industry expert's reveal that nearly 70% of consumers in the US consider sustainability when making beverage choices. Consequently, the flavored water market is adopting eco-friendly practices, such as using recyclable materials and reducing plastic waste. This commitment to sustainability not only resonates with environmentally conscious consumers but also enhances brand loyalty and reputation. Companies are likely to invest in sustainable initiatives to align with consumer values and differentiate themselves in a competitive landscape.

Rising Demand for Functional Beverages

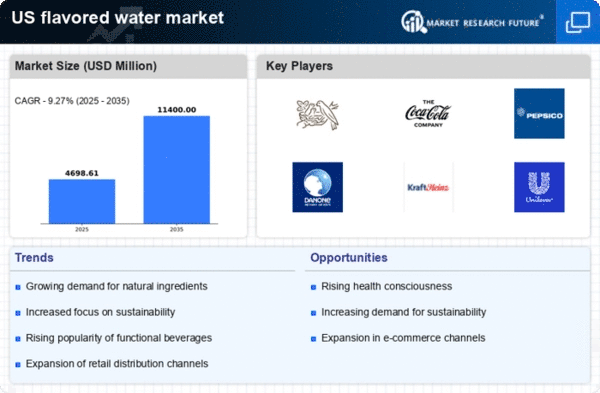

The flavored water market is experiencing a notable increase in demand for functional beverages, which are perceived as healthier alternatives to sugary drinks. Consumers are increasingly seeking beverages that offer additional health benefits, such as hydration, vitamins, and minerals. This trend is reflected in the market data, which indicates that the flavored water market is projected to grow at a CAGR of approximately 8% from 2025 to 2030. The shift towards functional beverages is driven by a growing awareness of health and wellness, prompting consumers to opt for flavored water that not only quenches thirst but also supports their overall well-being. As a result, the flavored water market is adapting to meet these evolving consumer preferences by introducing products enriched with electrolytes, antioxidants, and other beneficial ingredients.

Increased Focus on Clean Label Products

In the flavored water market, there is a significant shift towards clean label products, which are characterized by transparency in ingredient sourcing and minimal processing. Consumers are becoming more discerning about what they consume, leading to a preference for products that contain natural flavors and no artificial additives. This trend is supported by Industry expert's indicating that over 60% of consumers in the US are willing to pay a premium for clean label beverages. As a result, brands within the flavored water market are reformulating their products to align with these consumer expectations, emphasizing simplicity and authenticity in their ingredient lists. This focus on clean labels not only enhances consumer trust but also positions brands favorably in a competitive market.

Growing Popularity of On-the-Go Consumption

The flavored water market is witnessing a surge in the popularity of on-the-go consumption, driven by the fast-paced lifestyles of consumers. As more individuals seek convenient and portable hydration options, flavored water is emerging as a preferred choice. Market data suggests that single-serve packaging is gaining traction, with sales of portable flavored water products increasing by approximately 15% in the past year. This trend is particularly evident among younger demographics, who prioritize convenience and are more likely to choose flavored water as a quick and refreshing option. The flavored water market is responding by innovating packaging solutions that cater to this demand, ensuring that products are easily accessible for consumers on the move.