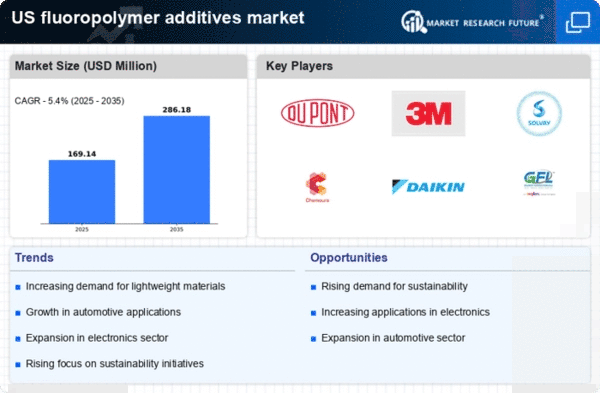

The fluoropolymer additives market is characterized by a dynamic competitive landscape, driven by innovation, sustainability, and strategic partnerships. Major players such as DuPont (US), 3M (US), and Chemours (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. DuPont (US) focuses on innovation in product development, particularly in high-performance applications, while 3M (US) emphasizes sustainability through its commitment to reducing environmental impact. Chemours (US), on the other hand, is leveraging its strong portfolio of fluoropolymer products to expand into emerging markets, indicating a trend towards regional diversification among key players.The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The competitive structure of the market appears moderately fragmented, with a mix of established players and emerging companies vying for market share. This fragmentation is influenced by the diverse applications of fluoropolymer additives across various industries, including automotive, electronics, and construction.

In October DuPont (US) announced the launch of a new line of environmentally friendly fluoropolymer additives aimed at reducing carbon emissions in manufacturing processes. This strategic move not only aligns with global sustainability goals but also positions DuPont (US) as a leader in eco-friendly innovations within the sector. The introduction of these products is likely to attract environmentally conscious customers and enhance the company's competitive edge.

In September 3M (US) revealed a partnership with a leading automotive manufacturer to develop advanced fluoropolymer coatings that improve fuel efficiency and reduce emissions. This collaboration underscores 3M's (US) commitment to innovation and sustainability, as it seeks to integrate its cutting-edge technologies into the automotive sector. Such partnerships may enhance 3M's (US) market presence and drive growth in the automotive applications segment.

In August Chemours (US) expanded its production capacity for fluoropolymer additives in response to increasing demand from the electronics industry. This expansion is indicative of Chemours' (US) proactive approach to scaling operations and meeting market needs. By increasing capacity, Chemours (US) is likely to strengthen its position in the electronics sector, which is experiencing rapid growth due to technological advancements.

As of November the competitive trends in the fluoropolymer additives market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and enhancing supply chain reliability. Looking ahead, the competitive differentiation in this market is expected to shift from price-based competition to a focus on innovation and technological advancements, as companies strive to meet evolving customer demands and regulatory requirements.