Increased Focus on Health and Wellness

The growing emphasis on health and wellness among consumers is significantly impacting the US Food And Beverages Color Fixing Agents Market. As individuals become more aware of the link between diet and health, there is a rising demand for products that not only look appealing but also contribute to overall well-being. This trend has prompted food and beverage manufacturers to explore color fixing agents that offer additional health benefits, such as antioxidants and vitamins. Market Research Future indicates that products featuring natural colorants are perceived as healthier alternatives, leading to increased sales. Consequently, companies are reformulating their products to include these beneficial color fixing agents, thereby catering to the evolving preferences of health-conscious consumers.

Rising Demand for Clean Label Products

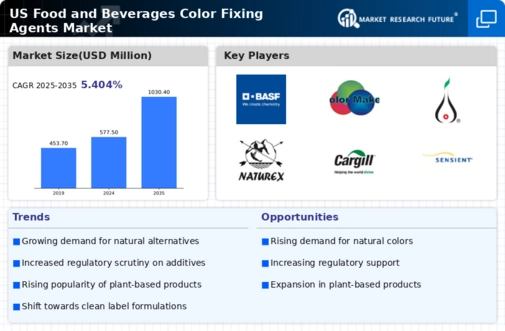

The US Food And Beverages Color Fixing Agents Market is experiencing a notable shift towards clean label products, driven by consumer preferences for transparency and natural ingredients. As consumers become increasingly health-conscious, they seek products that are free from artificial additives. This trend has led manufacturers to reformulate their offerings, incorporating natural color fixing agents derived from fruits, vegetables, and other plant sources. According to recent data, the market for natural colorants is projected to grow significantly, with a compound annual growth rate (CAGR) of over 5% in the coming years. This demand for clean label products not only influences the types of color fixing agents used but also shapes marketing strategies, as companies strive to communicate their commitment to quality and health.

Sustainability and Environmental Concerns

Sustainability is becoming a pivotal driver in the US Food And Beverages Color Fixing Agents Market. As consumers increasingly prioritize environmentally friendly products, manufacturers are responding by sourcing color fixing agents from sustainable and renewable resources. This shift is not only beneficial for the environment but also aligns with consumer values, fostering brand loyalty. Companies are exploring innovative ways to reduce their carbon footprint, such as utilizing waste materials from food production as sources for natural colorants. Market data suggests that products marketed as sustainable are experiencing higher demand, indicating a potential growth area for businesses. By embracing sustainability, companies can differentiate themselves in a competitive market while contributing positively to environmental conservation.

Regulatory Developments and Compliance Requirements

The regulatory landscape surrounding food additives, including color fixing agents, is becoming increasingly stringent in the US Food And Beverages Color Fixing Agents Market. Government agencies, such as the Food and Drug Administration (FDA), are implementing stricter guidelines to ensure consumer safety and product integrity. This regulatory scrutiny compels manufacturers to invest in compliance measures and adopt safer, approved color fixing agents. As a result, there is a growing trend towards the use of natural and organic colorants that meet these regulatory standards. Companies that proactively adapt to these changes not only mitigate risks but also enhance their brand reputation by demonstrating a commitment to safety and quality. This regulatory environment is likely to shape the future landscape of the market.

Technological Advancements in Color Fixing Techniques

Technological innovations are playing a crucial role in the US Food And Beverages Color Fixing Agents Market. Advances in extraction and processing techniques have enhanced the efficiency and effectiveness of natural colorants, making them more appealing to manufacturers. For instance, new methods such as microencapsulation and nanotechnology are being employed to improve the stability and shelf-life of color fixing agents. This has resulted in a broader application of natural colorants across various food and beverage products, including dairy, confectionery, and beverages. The integration of technology not only boosts product quality but also aligns with consumer expectations for vibrant and visually appealing products. As a result, companies that invest in these technological advancements are likely to gain a competitive edge in the market.