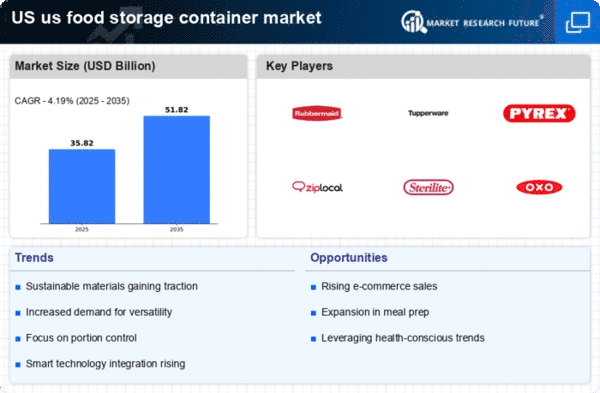

The Food Storage Container Market in the US is characterized by a dynamic competitive landscape, driven by innovation, sustainability, and consumer demand for convenience. Key players such as Rubbermaid (US), Tupperware (US), and Pyrex (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Rubbermaid (US) focuses on product innovation and sustainability, introducing eco-friendly materials in their containers, while Tupperware (US) emphasizes direct sales and community engagement to foster brand loyalty. Pyrex (US), known for its glass storage solutions, leverages its heritage and quality to appeal to health-conscious consumers. Collectively, these strategies contribute to a moderately fragmented market, where differentiation is increasingly vital.

In terms of business tactics, companies are localizing manufacturing to reduce lead times and optimize supply chains. This approach not only enhances operational efficiency but also aligns with growing consumer preferences for locally sourced products. The competitive structure remains moderately fragmented, with several players vying for market share, yet the influence of major brands is palpable, as they set trends and standards that smaller companies often follow.

In December 2025, Rubbermaid (US) launched a new line of biodegradable food storage containers, marking a significant step towards sustainability. This initiative not only caters to the environmentally conscious consumer but also positions Rubbermaid (US) as a leader in eco-friendly innovations within the market. The strategic importance of this move lies in its potential to attract a growing segment of consumers who prioritize sustainability in their purchasing decisions.

In November 2025, Tupperware (US) announced a partnership with a leading e-commerce platform to enhance its online sales capabilities. This strategic alliance aims to expand Tupperware's (US) reach and improve customer engagement through digital channels. The significance of this partnership is underscored by the increasing shift towards online shopping, particularly in the home goods sector, suggesting that Tupperware (US) is adapting to changing consumer behaviors effectively.

In October 2025, Pyrex (US) introduced a new range of microwave-safe glass containers, designed to meet the rising demand for versatile kitchen solutions. This product launch not only reinforces Pyrex's (US) commitment to quality but also addresses consumer needs for convenience and safety in food storage. The strategic importance of this development lies in its alignment with current trends favoring health-conscious and multifunctional kitchenware.

As of January 2026, the Food Storage Container Market is witnessing trends such as digitalization, sustainability, and the integration of AI technologies. Companies are increasingly forming strategic alliances to enhance their competitive edge, particularly in areas like supply chain optimization and product innovation. The competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technology, and reliability in supply chains, reflecting a broader shift in consumer expectations and market dynamics.