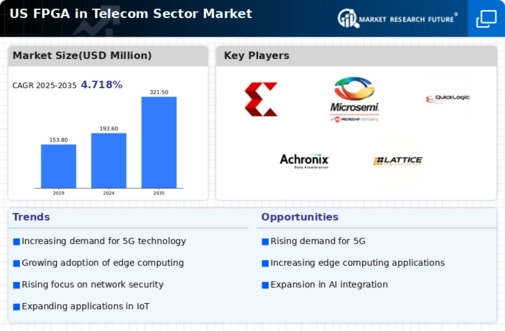

The US FPGA in Telecom Sector Market is characterized by a dynamic landscape influenced by rapid technological advancements and increasing demand for high-performance network solutions. The market features an array of companies that offer innovative FPGA solutions designed to address the specific needs of the telecom industry, including enhanced data throughput, reduced latency, and improved energy efficiency.

Competitive insights reveal a strong focus on providing customizable solutions and integrating FPGAs into various telecommunications equipment, such as routers, switches, and base stations. As the telecommunications infrastructure evolves, key players in the FPGA market are continually adapting their offerings to maintain a competitive edge, responding to the growing demand for 5G and beyond, which necessitates sophisticated and adaptable components.Maxim Integrated has carved a niche for itself within the US FPGA in Telecom Sector Market by leveraging its expertise in analog integration and high-performance mixed-signal solutions.

The company’s strength lies in its ability to deliver comprehensive FPGA solutions that enhance overall system performance for telecom applications.

With a robust portfolio that includes specialized FPGAs tailored for telecom functionalities, Maxim Integrated has established a strong market presence through innovative designs that focus on optimizing power consumption and enhancing signal integrity.

Its commitment to research and development allows it to stay ahead of industry trends, ensuring that it meets the ever-evolving needs of telecom service providers. Moreover, its focus on customer partnerships and collaborative development further boosts its competitive standing in the market.

Broadcom operates as a major player in the US FPGA in Telecom Sector Market, offering a diverse range of products and services that cater specifically to the demands of the telecommunications industry. Known for its high-performance FPGAs, Broadcom provides solutions that facilitate the transition to 5G infrastructure, enabling faster data rates and better connectivity.

The company's strengths lie in its extensive market presence and its ability to deliver integrated solutions that combine various functionalities to streamline network operations. Broadcom’s strategy often includes mergers and acquisitions that enhance its technological capabilities and expand its portfolio, securing its position as a leader in the market.

With initiatives focusing on innovation in broadband connectivity and advanced wireless technologies, the company's robust offerings have solidified its reputation within the telecom sector, allowing it to maintain a competitive edge against other players in the FPGA market.