Rising Industrial Demand

The gas concentration-sensor market is experiencing a notable surge in demand from various industrial sectors, particularly manufacturing and chemical processing. As industries increasingly prioritize safety and efficiency, the need for precise gas monitoring solutions becomes paramount. In 2025, the market is projected to reach approximately $1.5 billion, driven by the necessity for compliance with stringent safety regulations. Industries are adopting advanced gas concentration sensors to mitigate risks associated with toxic gas emissions and ensure worker safety. This trend indicates a robust growth trajectory for the gas concentration-sensor market, as companies invest in technology to enhance operational safety and efficiency.

Technological Advancements

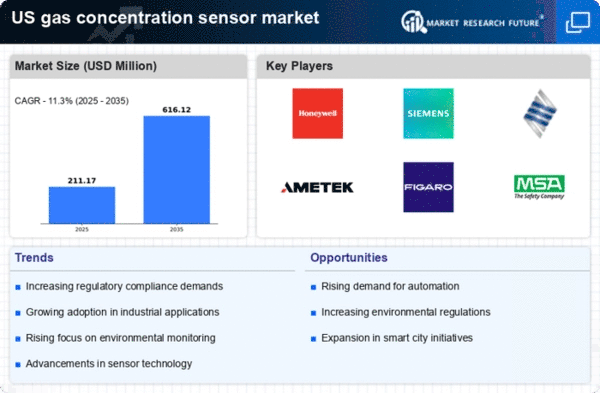

Technological innovations play a crucial role in shaping the gas concentration-sensor market. The integration of advanced sensing technologies, such as MEMS and nanotechnology, enhances the accuracy and reliability of gas detection systems. In 2025, the market is expected to witness a compound annual growth rate (CAGR) of around 8%, fueled by the introduction of smart sensors that offer real-time monitoring and data analytics capabilities. These advancements not only improve detection sensitivity but also reduce response times, making them indispensable in various applications, including environmental monitoring and industrial safety. The ongoing evolution of sensor technology is likely to propel the gas concentration-sensor market forward.

Government Initiatives and Funding

Government initiatives aimed at improving environmental safety and public health are driving growth in the gas concentration-sensor market. Various federal and state programs are providing funding for the development and deployment of advanced gas monitoring technologies. In 2025, it is anticipated that government investments will account for a significant portion of the market, potentially reaching $300 million. These initiatives not only promote the adoption of gas concentration sensors in industrial applications but also encourage research and development in sensor technology. The support from government bodies is likely to enhance the market landscape, fostering innovation and expanding the reach of gas concentration-sensor solutions.

Increased Awareness of Air Quality

Growing public awareness regarding air quality and its impact on health is significantly influencing the gas concentration-sensor market. As concerns about pollution and its effects on respiratory health rise, there is a heightened demand for gas sensors that can monitor air quality in real-time. The market is projected to expand as municipalities and organizations invest in monitoring systems to ensure compliance with air quality standards. In 2025, the market could see an increase of approximately 15% in demand from the environmental sector, as more entities recognize the importance of maintaining safe air quality levels. This trend underscores the critical role of gas concentration sensors in public health initiatives.

Emerging Applications in Healthcare

the gas concentration-sensor market is seeing emerging applications in the healthcare sector, particularly in patient monitoring and diagnostics.. The demand for non-invasive gas sensors that can measure respiratory gases is increasing, driven by the need for accurate monitoring of patients' health conditions. In 2025, the healthcare segment is expected to contribute significantly to the market, with projections indicating a growth rate of around 10%. This trend reflects the potential of gas concentration sensors to enhance patient care and safety in clinical settings. As healthcare providers seek innovative solutions to improve patient outcomes, the gas concentration-sensor market is likely to benefit from this growing interest.