Rising Energy Demand

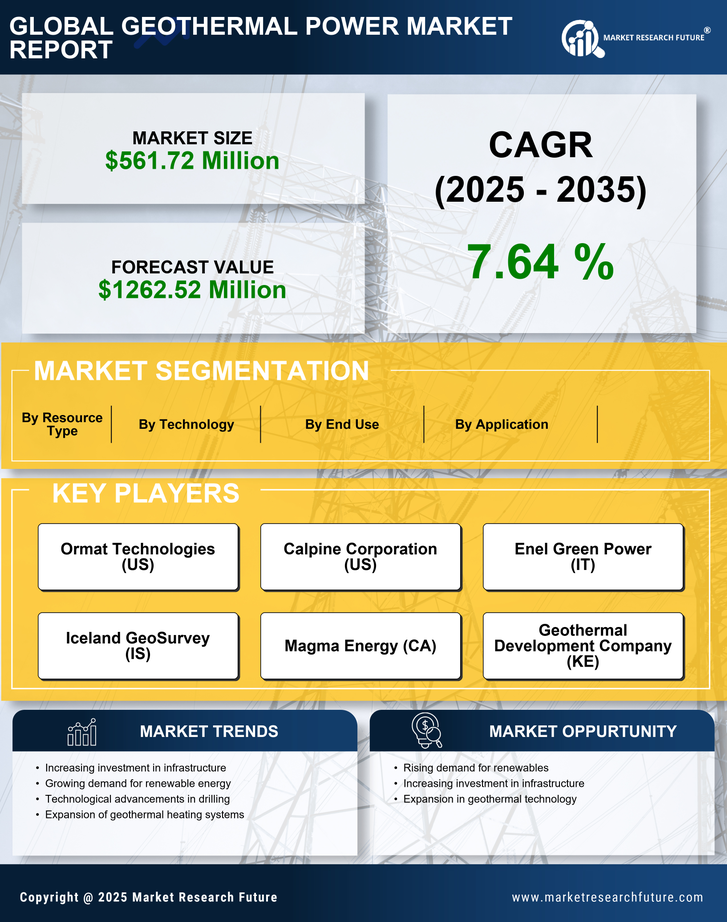

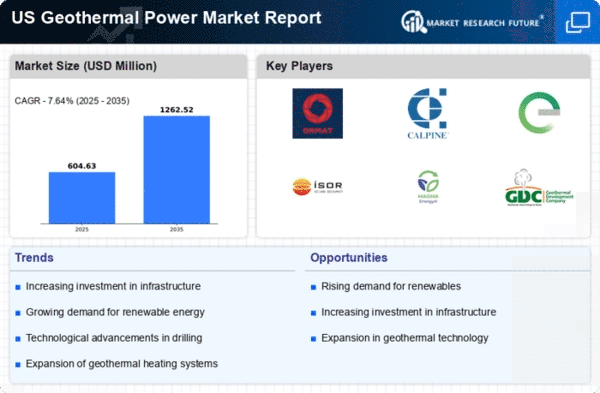

The geothermal power market is experiencing a notable surge in energy demand across the United States. As the population grows and industrial activities expand, the need for sustainable and reliable energy sources becomes increasingly critical. In 2025, the U.S. energy consumption is projected to rise by approximately 1.5% annually, with renewable sources, including geothermal, playing a pivotal role in meeting this demand. The geothermal power market is well-positioned to capitalize on this trend, as it offers a consistent and stable energy supply, unlike some intermittent renewable sources. Furthermore, the increasing focus on energy independence and security is likely to drive investments in geothermal projects, enhancing the market's growth potential.

Government Incentives and Funding

The geothermal power market is significantly supported by various government incentives and funding programs aimed at promoting renewable energy sources. In 2025, federal and state governments are expected to allocate substantial financial resources to support geothermal projects, including grants, tax credits, and low-interest loans. These incentives are designed to lower the financial barriers for developers and encourage investment in the geothermal power market. As a result, the market is likely to witness an influx of new projects and expansions of existing facilities, contributing to a more robust geothermal energy landscape in the United States. The financial backing from government initiatives is crucial for the long-term sustainability and growth of the geothermal power market.

Technological Innovations in Drilling

The geothermal power market is benefiting from advancements in drilling technologies that enhance the efficiency and cost-effectiveness of geothermal energy extraction. Innovations such as enhanced geothermal systems (EGS) and improved drilling techniques are reducing the costs associated with geothermal projects. In 2025, the average cost of geothermal energy is expected to decrease by 10-15% due to these technological improvements. The geothermal power market is likely to see increased project viability and competitiveness against other renewable sources as a result. These innovations not only facilitate the development of new geothermal plants but also enable the retrofitting of existing facilities, thereby expanding the overall capacity of the geothermal power market.

Growing Investment in Renewable Energy

The geothermal power market is experiencing a surge in investment as stakeholders increasingly recognize the potential of renewable energy sources. In 2025, investments in renewable energy in the United States are projected to exceed $100 billion, with geothermal power being a key beneficiary. The geothermal power market is attracting interest from both private investors and institutional funds, driven by the desire for sustainable and profitable energy solutions. This influx of capital is likely to facilitate the development of new geothermal projects and enhance existing operations, thereby expanding the market's capacity. As the transition to a low-carbon economy accelerates, the geothermal power market is poised to play a vital role in meeting the nation's energy needs.

Environmental Sustainability Initiatives

The geothermal power market is significantly influenced by the growing emphasis on environmental sustainability initiatives in the United States. With climate change concerns at the forefront of public policy, there is a strong push for cleaner energy solutions. The geothermal power market aligns well with these initiatives, as it produces minimal greenhouse gas emissions compared to fossil fuels. In 2025, the U.S. government aims to reduce carbon emissions by 50% from 2005 levels, which could lead to increased funding and support for geothermal projects. This commitment to sustainability not only enhances the market's appeal but also encourages private sector investments, further propelling the growth of the geothermal power market.