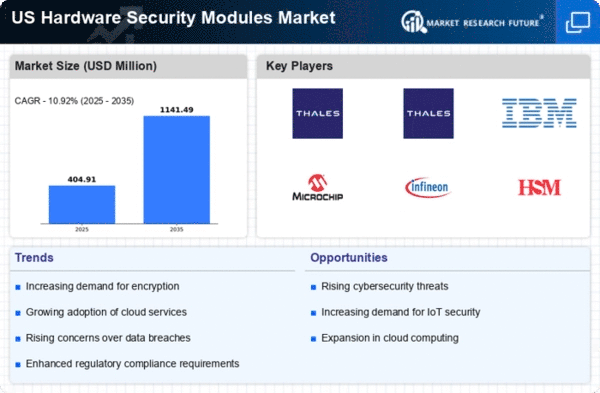

The hardware security-modules market is currently characterized by a dynamic competitive landscape, driven by increasing demand for data protection and regulatory compliance across various sectors. Key players such as IBM (US), Thales (FR), and AWS (US) are strategically positioned to leverage their technological expertise and extensive portfolios. IBM (US) focuses on integrating advanced AI capabilities into its HSM offerings, enhancing security measures while streamlining operations. Thales (FR) emphasizes innovation through continuous investment in R&D, aiming to develop next-generation security solutions. AWS (US) is expanding its cloud-based HSM services, catering to the growing need for scalable and flexible security solutions in the cloud environment. Collectively, these strategies contribute to a competitive environment that prioritizes technological advancement and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance operational efficiency and reduce costs. The market structure appears moderately fragmented, with several players vying for market share while also forming strategic alliances to bolster their competitive positions. This collective influence of key players fosters a collaborative atmosphere, where innovation and customer service are paramount.

In October 2025, IBM (US) announced a partnership with a leading financial institution to integrate its HSM technology into the bank's digital infrastructure. This collaboration is expected to enhance the bank's security posture, particularly in safeguarding sensitive customer data. The strategic importance of this move lies in IBM's ability to showcase its HSM capabilities in a high-stakes environment, potentially attracting further clients from the financial sector.

In September 2025, Thales (FR) launched a new line of HSMs designed specifically for IoT applications, addressing the growing security concerns associated with connected devices. This initiative not only positions Thales as a leader in IoT security but also reflects the company's commitment to innovation in response to emerging market needs. The strategic significance of this launch is underscored by the increasing adoption of IoT technologies across various industries, which necessitates robust security solutions.

In August 2025, AWS (US) expanded its HSM offerings by introducing a new service that allows customers to manage their encryption keys more efficiently. This enhancement is particularly relevant as organizations increasingly migrate to cloud environments, where data security remains a top priority. The strategic importance of this development lies in AWS's ability to provide a comprehensive security solution that aligns with the evolving needs of its customer base.

As of November 2025, current competitive trends in the hardware security-modules market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and enhancing service offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability, as organizations seek to establish themselves as leaders in a rapidly changing landscape.