Technological Advancements in Diagnostics

The healthcare bioconvergence market is experiencing a surge due to rapid technological advancements in diagnostics. Innovations such as next-generation sequencing and advanced imaging techniques are enhancing the accuracy and speed of disease detection. These technologies enable healthcare providers to deliver more precise treatments tailored to individual patient needs. The market for diagnostic devices is projected to reach approximately $200 billion by 2026, indicating a robust growth trajectory. As these technologies become more integrated into clinical practice, they are likely to drive demand for bioconvergence solutions that combine biological insights with technological capabilities, thereby transforming patient care.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is emerging as a key driver in the healthcare bioconvergence market. Agencies such as the FDA are increasingly adopting frameworks that expedite the approval of novel treatments and technologies. This regulatory environment encourages investment and innovation, as companies are more willing to develop bioconvergence solutions that may receive faster market access. In recent years, the FDA has approved a growing number of breakthrough therapies, reflecting a commitment to fostering innovation. As regulatory pathways become more streamlined, the healthcare bioconvergence market is expected to flourish, enabling the introduction of cutting-edge solutions that enhance patient care.

Aging Population and Chronic Disease Management

The aging population in the United States is a significant driver of the healthcare bioconvergence market. As individuals age, they often face multiple chronic conditions that require complex management strategies. This demographic shift is leading to an increased demand for innovative solutions that can effectively address these challenges. By 2030, it is estimated that nearly 20% of the U.S. population will be over 65 years old, intensifying the need for integrated healthcare solutions. The healthcare bioconvergence market is likely to respond by developing technologies that facilitate better management of chronic diseases, ultimately improving quality of life for older adults.

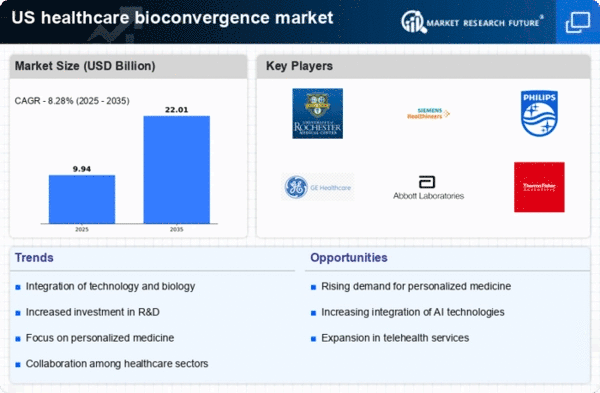

Increased Investment in Research and Development

Investment in research and development (R&D) is a critical driver of the healthcare bioconvergence market. With funding from both public and private sectors, innovative solutions are being developed that merge biology with technology. In 2025, R&D spending in the healthcare sector is expected to exceed $200 billion, reflecting a strong commitment to advancing bioconvergence initiatives. This influx of capital supports the development of new therapies and diagnostic tools, fostering collaboration between biotech firms and technology companies. As a result, the healthcare bioconvergence market is likely to expand, offering new opportunities for growth and innovation.

Growing Demand for Integrated Healthcare Solutions

The healthcare bioconvergence market is being propelled by a growing demand for integrated healthcare solutions. Patients and providers alike are seeking comprehensive approaches that combine diagnostics, treatment, and monitoring into cohesive systems. This trend is evident in the rise of digital health platforms that facilitate seamless communication between patients and healthcare professionals. By 2025, the digital health market is projected to reach $500 billion, underscoring the shift towards integrated solutions. Such systems not only improve patient outcomes but also enhance operational efficiencies, making them attractive to healthcare providers and stakeholders in the bioconvergence market.