Adoption of Telehealth Services

The rise of telehealth services significantly influences the healthcare data-storage market. As more patients and providers engage in virtual consultations, the volume of data generated increases exponentially. This trend necessitates the implementation of reliable data storage solutions capable of handling large datasets securely. In 2025, it is anticipated that telehealth will account for nearly 30% of all healthcare visits in the US, further driving the demand for efficient data storage systems. The healthcare data-storage market must evolve to support this shift, ensuring that data is not only stored securely but also remains accessible for healthcare professionals. This growing reliance on telehealth services suggests a potential for innovation in storage technologies, as providers seek to enhance their capabilities in managing patient data effectively.

Emergence of Big Data Analytics

The healthcare data-storage market is increasingly influenced by the emergence of big data analytics. As healthcare organizations collect vast amounts of data, the need for sophisticated storage solutions that facilitate data analysis becomes evident. In 2025, it is estimated that the healthcare analytics market will reach $50 billion, highlighting the importance of data storage in supporting analytical processes. Organizations are seeking storage solutions that not only secure data but also enable real-time analytics, thereby improving decision-making and patient outcomes. The integration of big data analytics into healthcare practices indicates a growing demand for advanced storage technologies that can accommodate complex datasets. This trend suggests that the healthcare data-storage market will continue to expand as organizations recognize the value of data-driven insights.

Regulatory Compliance and Data Protection

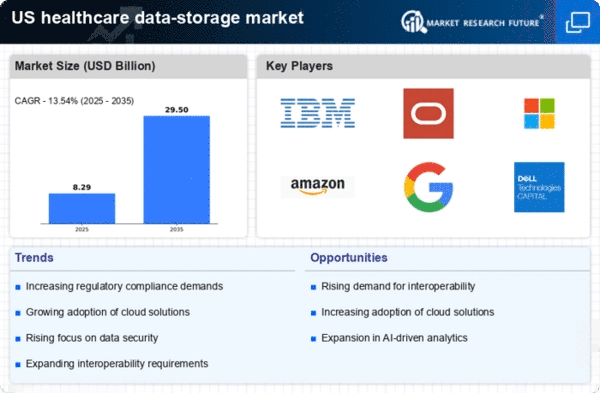

Regulatory compliance plays a critical role in shaping the healthcare data-storage market. With stringent regulations such as HIPAA in place, healthcare organizations are compelled to implement secure data storage solutions that protect patient information. Non-compliance can result in hefty fines, which can reach up to $50,000 per violation. As a result, healthcare providers are increasingly investing in advanced storage technologies that ensure compliance with these regulations. The emphasis on data protection not only safeguards patient privacy but also enhances the overall integrity of healthcare systems. In 2025, the market is projected to grow by approximately 15% as organizations prioritize compliance-driven storage solutions, indicating a robust demand for services that align with regulatory standards in the healthcare data-storage market.

Increasing Demand for Electronic Health Records

The healthcare data-storage market experiences a notable surge in demand for electronic health records (EHRs). As healthcare providers transition from paper-based systems to digital formats, the need for secure and efficient data storage solutions becomes paramount. In 2025, it is estimated that over 90% of hospitals in the US have adopted EHR systems, driving the market's growth. This shift not only enhances patient care but also necessitates robust data storage infrastructures to manage the vast amounts of information generated. The healthcare data-storage market must adapt to accommodate this influx, ensuring that data is stored securely and is easily accessible for healthcare professionals. Furthermore, the integration of EHRs with other healthcare technologies amplifies the need for scalable storage solutions, indicating a sustained growth trajectory for the industry.

Technological Advancements in Storage Solutions

Technological advancements are reshaping the landscape of the healthcare data-storage market. Innovations such as artificial intelligence and machine learning are being integrated into storage solutions, enhancing data management capabilities. In 2025, it is projected that the market for AI-driven storage solutions will grow by 20%, reflecting the increasing reliance on technology to optimize data storage processes. These advancements not only improve efficiency but also bolster security measures, addressing the growing concerns surrounding data breaches. As healthcare organizations seek to leverage technology for better data management, the healthcare data-storage market is likely to witness a transformation, with providers adopting cutting-edge solutions that align with their operational needs.