Supportive Regulatory Frameworks

The US Heat Meter Market benefits from a supportive regulatory environment that encourages the adoption of heat metering technologies. Federal and state policies aimed at promoting energy efficiency and reducing greenhouse gas emissions are creating a favorable landscape for heat meter deployment. For instance, the Energy Policy Act and various state-level initiatives incentivize the installation of advanced metering infrastructure. These regulations not only facilitate compliance with energy efficiency standards but also promote investment in heat meter technologies. As regulatory pressures continue to mount, the market is expected to expand, driven by the need for compliance and the pursuit of sustainability goals.

Growing Demand for Energy Efficiency

The US Heat Meter Market is experiencing a notable surge in demand for energy-efficient solutions. This trend is largely driven by increasing energy costs and a heightened awareness of environmental sustainability. According to the U.S. Energy Information Administration, residential energy consumption has been on the rise, prompting consumers and businesses alike to seek out technologies that can optimize energy use. Heat meters, which provide precise measurements of energy consumption, are becoming essential tools for achieving these efficiency goals. As a result, the market is likely to see a significant uptick in the adoption of heat meters, as stakeholders aim to reduce waste and lower operational costs.

Increased Focus on Renewable Energy Integration

The US Heat Meter Market is increasingly aligned with the growing focus on integrating renewable energy sources into the heating sector. As the nation shifts towards cleaner energy alternatives, the need for accurate measurement and monitoring of energy consumption becomes paramount. Heat meters play a crucial role in this transition by providing data that helps optimize the use of renewable energy in heating applications. The U.S. Department of Energy has set ambitious targets for renewable energy adoption, which is likely to drive demand for heat meters that can effectively measure energy sourced from renewables. This alignment with sustainability initiatives positions the heat meter market for robust growth in the coming years.

Technological Advancements in Metering Solutions

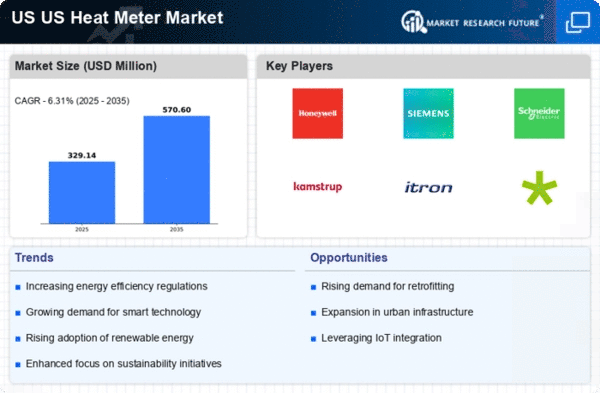

The US Heat Meter Market is witnessing rapid technological advancements that enhance the functionality and accuracy of heat meters. Innovations such as wireless communication, IoT integration, and advanced data analytics are transforming traditional metering systems into smart solutions. These technologies enable real-time monitoring and reporting, which can lead to improved energy management practices. The market for smart heat meters is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is indicative of a broader trend towards digitization in energy management, making heat meters a critical component in modern energy systems.

Rising Urbanization and Infrastructure Development

The US Heat Meter Market is significantly influenced by the ongoing trends of urbanization and infrastructure development. As cities expand and new residential and commercial buildings are constructed, the demand for efficient heating solutions is increasing. Urban areas are particularly focused on implementing smart city initiatives, which often include the integration of advanced metering technologies. The U.S. Census Bureau indicates that urban populations are projected to grow, leading to a higher demand for reliable heating systems. Consequently, heat meters are becoming indispensable in new constructions, further propelling market growth as stakeholders seek to enhance energy efficiency in urban settings.