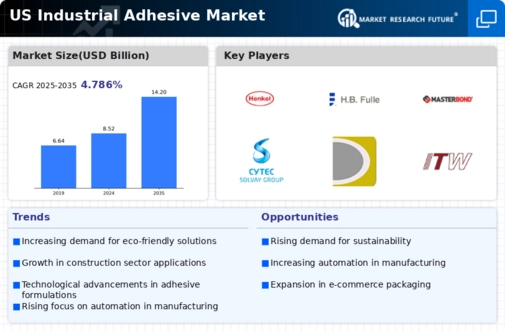

The industrial adhesive market is characterized by a dynamic competitive landscape, driven by innovation, sustainability, and technological advancements. Key players such as 3M (US), Henkel (DE), and H.B. Fuller (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. 3M (US) emphasizes innovation through extensive R&D investments, focusing on developing high-performance adhesives tailored for diverse applications. Henkel (DE), on the other hand, leverages its global footprint to optimize supply chains and enhance customer engagement, while H.B. Fuller (US) concentrates on strategic acquisitions to expand its product portfolio and market reach. Collectively, these strategies contribute to a competitive environment that is increasingly focused on differentiation through quality and performance rather than solely on price.

The market structure appears moderately fragmented, with a mix of large multinational corporations and smaller specialized firms. Key players are localizing manufacturing to reduce lead times and enhance responsiveness to customer needs. Supply chain optimization remains a critical tactic, as companies strive to mitigate risks and improve efficiency. This collective approach by major players fosters a competitive atmosphere where innovation and operational excellence are paramount.

In November 2025, 3M (US) announced the launch of a new line of bio-based adhesives aimed at reducing environmental impact. This strategic move not only aligns with global sustainability trends but also positions 3M (US) as a leader in eco-friendly solutions, potentially attracting environmentally conscious customers and industries. The introduction of these products may enhance their competitive edge in a market increasingly driven by sustainability.

In October 2025, Henkel (DE) expanded its partnership with a leading automotive manufacturer to supply advanced adhesive solutions for electric vehicles. This collaboration underscores Henkel's commitment to innovation in the automotive sector, particularly as the industry shifts towards electrification. By aligning with key players in the automotive market, Henkel (DE) is likely to strengthen its market presence and drive growth in a rapidly evolving sector.

In September 2025, H.B. Fuller (US) completed the acquisition of a specialty adhesive manufacturer, enhancing its capabilities in high-performance applications. This acquisition is strategically significant as it allows H.B. Fuller (US) to broaden its product offerings and cater to niche markets, thereby reinforcing its competitive position. The integration of new technologies and expertise from the acquired company may also facilitate innovation in product development.

As of December 2025, the industrial adhesive market is witnessing trends such as digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to leverage complementary strengths and enhance their market offerings. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to deliver superior products and services that meet evolving customer demands.

Leave a Comment